Blog

Institutional investors aiming for the highest ROI in industrial bitcoin mining and large scale mining should prioritize energy-efficient ASIC hardware and careful financial management. Recent data indicates that investing over $100,000 in large scale mining operations often requires more than 2 or 3 years to break even, due to the volatile crypto market, hardware depreciation, and high electricity costs. Those who develop a strategic plan, seek out low power rates, and explore opportunities for expansion in industrial bitcoin mining tend to outperform others. Institutional crypto investors also benefit from owning more aspects of the business and diversifying into other crypto services. These strategies help reduce risk and adapt to the rapid changes in the crypto industry. Successful large scale mining projects demand professional planning and a team prepared to evolve as the crypto landscape matures.

Key Takeaways

Pick ASIC hardware that uses less energy and find cheap power to help you make more money and spend less.

Make clear goals for your investment and handle risk by keeping a good mix of bitcoin, debt, and cash so you can stay strong for a long time.

To maximize ROI and grow efficiently, pick your mining approach based on your strategy, location, and power costs.

Take care of your mining machines and upgrade them often so they do not break and you can keep up with new tech.

Handle money risks by making a budget, getting insurance, using hedging, and following rules to keep your money safe and get steady profits.

Investment Goals and Risk

Setting Effective Investment Objectives

People who invest in big bitcoin mining need to set clear goals first. Many want to build a strong money base. They usually keep more cash than debt. This helps them get through hard times and lets them grow. This way, they can grow their share in the market, stay profitable if bitcoin prices fall, and only sell bitcoin when they need cash.

Common goals are:

Making sure there is enough cash for costs.

Keeping bitcoin and spending balanced.

Growing mining power for future gains.

Investors use different ways to reach these goals. Some keep all the bitcoin they mine and hope prices go up later. Others sell some bitcoin to pay for costs and save the rest. Another group sells most of their bitcoin to have steady cash. Each way fits a different risk level and business plan.

Tip: Investors with less debt can handle market changes better and find new chances to grow.

Risk Tolerance

Risk is a fundamental component of every mining and investment plan. Investors must clearly define their risk tolerance—that is, how much loss they are willing and able to accept. Those comfortable with higher risk often pursue aggressive strategies, such as holding large amounts of bitcoin or utilizing leverage through borrowed funds. They are willing to endure significant volatility in pursuit of potentially greater returns. However, it’s worth noting that many short-term speculators who adopt such high-risk approaches often end up with unsatisfactory results—whether from buying at a peak, selling in a panic on the way down, or accumulating losses from frequent trading and high transaction costs. In many cases, their actual returns fall short of expectations, and some even experience substantial losses.

On the other hand, investors with lower risk tolerance may limit their bitcoin exposure to a smaller portion of their portfolio, typically around only 3% to 5% of their money. Instead of direct ownership, they might opt for relatively safer instruments such as Bitcoin ETFs, which offer regulated exposure without the operational complexities of holding the asset directly.

In line with a more cautious approach, Elliott sees a minor role for Bitcoin in a long-term portfolio. He advises clients to adopt a “core and explore” strategy: “Ninety-five percent of your assets should be in a core, well-diversified portfolio tailored to your timeline and risk tolerance. The remaining 5% can be allocated to more speculative investments—such as Bitcoin—provided you have minimal debt and are prepared to potentially lose the amount invested.”

Good ways to manage risk are:

Checking if they can afford to lose money.

Making clear plans to leave if needed.

Not making choices based on feelings.

Using position sizing to limit risk.

Long term thinking is essential for handling Bitcoin’s volatility. Smart investors avoid using short-term savings or emergency funds, instead treating Bitcoin as a long-term (5+ years) wealth-building tool. By matching strategy to real risk capacity, they avoid chasing quick gains or acting out of fear.

Strategic Mining Deployment Models

Individual Mining

Individual mining lets investors have full control. They own the hardware and run the facility. They make all the choices. This plan is good for building a strong portfolio. Investors can improve every part of their setup. They work on power deals and cooling systems. They keep all the bitcoin they mine. This helps their portfolio grow faster. But, this model costs a lot at first. It needs deep technical skills. Investors must deal with all risks. These risks include hardware problems and market changes. For big mining, this way can give higher returns. The team must be good at managing portfolios.

Host Mining and Managed

Host mining uses a third party to run things. Investors pay for space, power, and upkeep. This plan means less need for tech staff. It also lowers risks in daily work. Many investors pick this to grow their portfolio. They do not have to handle daily jobs. Host mining helps people scale up fast. Managed services help enter new markets with less risk. Investors must place a high degree of trust in their chosen hosting provider, as this decision inherently involves ceding some control over their operations. Therefore, selecting a reputable and reliable company is paramount. For instance, Yesmining offers trusted hosting services to give investors peace of mind.

Diversify Investment

Diversification is fundamental for crypto investors. Rather than concentrating on a single asset, a prudent strategy involves building a balanced portfolio across various digital assets. This typically includes:

Bitcoin (BTC) as a store-of-value anchor.

Ethereum (ETH) for smart contract utility.

Other layer-1 and layer-2 tokens for broader ecosystem exposure.

DeFi governance tokens for sector-specific growth.

Stablecoins to mitigate volatility.

This approach reduces the risk of any single project’s failure severely impacting your portfolio. It also allows you to capture growth across different market sectors and helps smooth out returns over time. However, effective diversification requires more than just owning many coins; it demands the thoughtful selection of less-correlated assets and ongoing management to balance risk and reward.

Hardware Selection

Hash rate and power use help miners do well. Miners who pick efficient models like the S21 XP Hydro save money on energy. Cooling and firmware also help keep miners working. Big mining farms need good cooling to stop hardware from breaking.

ASIC Comparison

Picking the right ASIC miner is very important for ROI. Good hardware helps you make more money and spend less. The best miners in 2025, like the Bitmain Antminer S21 XP Hydro, are very strong and use less power. This miner has a hash rate of 473 TH/s and uses 12 J/TH. It is the best choice for big bitcoin mining farms. Other good miners are the Antminer S21 XP, S21 Pro, and MicroBT Whatsminer M66S Immersion. These miners balance hash rate and power use. This helps miners make more money in a tough market.

| ASIC Miner | Hashrate | Power Consumption | Efficiency | Daily Profitability | Notes |

|---|---|---|---|---|---|

| Bitmain Antminer S21e XP Hydro 3U | 860 TH/s | 11180W | 13 J/TH | $34.22 | Highest efficiency and power; suited for large-scale professional miners |

| Bitmain Antminer S21 XP Hydro | 473 TH/s | 5676 W | 12 J/TH | $19.70 | Water-cooling Bitcoin Miner; suited for large-scale professional miners; new model (June 2024) |

| Bitmain Antminer S21 XP | 270 TH/s | 3645 W | 13.5 J/TH | $10.58 | High-end, powerful, requires good cooling; industrial scale |

| Bitmain Antminer S21 Pro | 234 TH/s | 3510 W | 15 J/TH | $8.75 | Air-cooled, stable for 24/7 operation; supported by third-party firmware |

| Bitmain Antminer L11 | 20 GH/s | 3680 W | 0.184 J/MH | $19.97 | Highest efficiency and power; new model; A solid upgrade from the L9 |

| Bitmain Antminer L9 | 16 GH/s | 3645 W | 0.21 J/MH | $15.47 | Powerful, popular and durable; industrial scale |

Real examples show hardware choice changes ROI. Moving from CPUs to GPUs and then to ASICs made mining much better. However, selecting the right hardware is only half the battle. To protect that investment and ensure it delivers the projected ROI, miners must also avoid critical operational pitfalls. Miners should watch out for common mistakes. Not thinking about heat and noise can break hardware and make things uncomfortable. Bad heat control makes parts wear out faster and can crash rigs. Good cooling and putting rigs in quiet places help stop these problems.

Pitfall Category | Description | How to Avoid |

|---|---|---|

Hardware Efficiency | Picking hardware that uses too much power makes less money over time. | Prioritize miners with a low energy efficiency ratio (J/TH) to maximize profitability. |

Manufacturer Quality | Some brands lack reliability and have suboptimal after-sales support | Choose trusted brands like Bitmain or MicroBT for better support. |

Hosting Costs & Location | Old miners cost less but need cheap power to work well. | Check power and hosting prices; pick places with low costs. |

Environmental Factors | Some miners do not work well in hot places and may break. | Pick miners that fit the climate; use water or immersion cooling if it is hot. |

Diversified Hardware

Using new types of hardware helps miners avoid problems. Bitcoin mining hardware can break, become old, or be hard to get, which can lower the amount of bitcoin mined. Upgrading and using better hardware helps miners work more and lose less time.

Upgrading hardware often helps miners stay ahead.

Using both ASICs and GPUs gives backup if one type fails.

If new miners are hard to buy, having many types keeps mining going.

Power and cooling problems can stop mining. Using different miners with different cooling needs helps keep things running.

Miners who use the new model protect their mining from surprises. This plan helps them grow and stay strong as things change. Cleaning, fixing, and updating software keeps miners working well. Watching how rigs work and fixing problems fast helps miners get better results.

Tip: Clean rigs and update software often to stop overheating. Checking performance helps find problems early and keeps mining steady.

Cost Structure and Location

Power Costs

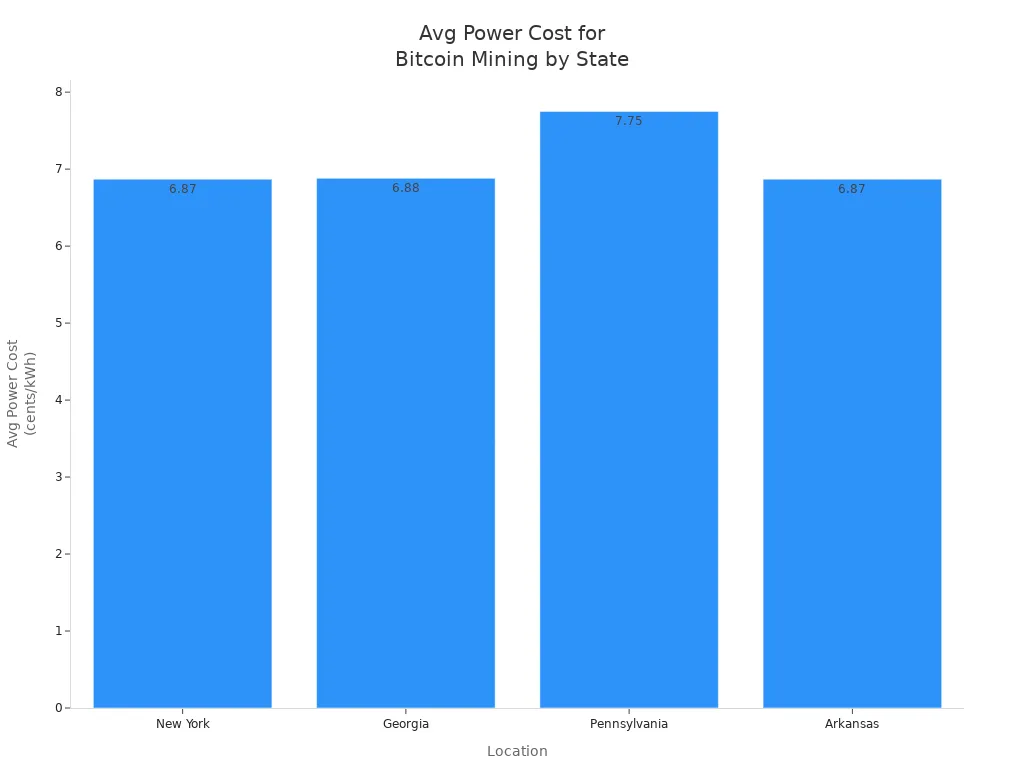

Power costs are very important for bitcoin mining. Miners want to find places with cheap electricity. This helps them make more money from crypto. The United States has many mining hubs with different power prices. Arkansas has very low rates, sometimes only 0.74 cents per kWh when it is not summer. Georgia and New York also have good prices for crypto miners. Some companies in Georgia pay just 1.2 cents per kWh at their own sites. The table below shows what big mining companies pay and the average power costs:

Average Industrial Power Cost (cents/kWh) | Notes on Mining Company Costs (cents/kWh) | |

|---|---|---|

Texas | N/A | Energy prices expected to rise |

New York | 6.87 | Digihost/World X Generation: ~3.0; Terawulf: ~3.0; Plattsburgh miners: 2.0 (before new rate) |

Georgia | 6.88 | CleanSpark Inc.: 4.6 (all-in), 3.1 (wholesale), as low as 1.2 at owned sites |

Pennsylvania | 7.75 | Stronghold Digital Mining: 2.0 to 5.2 |

Arkansas | 6.87 | Entergy Arkansas miners: ~1.0 (summer), ~0.74 (non-summer) |

Using renewable energy like solar, wind, and hydropower helps miners save money. These energy sources also help the environment by lowering pollution. Miners in Texas, Iceland, and Canada use renewables to keep costs down. They also make mining more reliable. A study showed that mining was profitable at 80 out of 83 planned renewable sites in the US. These sites used 62% of their clean energy for mining.

Facility Needs

A good bitcoin mining portfolio needs the right facility. The place should have cheap power and enough space for all the hardware. Miners do not pick homes because of noise problems. They use remote places or oil fields with extra space and wasted energy. The power supply must be strong and steady. Cooling systems like air or immersion cooling stop miners from getting too hot. Security is important, so guards and cameras protect the equipment. Backup systems help keep mining running more than 95% of the time. Fast internet is needed for smooth mining. Miners must also follow local rules to stay legal.

Facility Requirement | Explanation |

|---|---|

Location | Cheap power, enough space, away from homes, easy delivery |

Power Supply | Reliable, low-cost electricity for high energy use |

Cooling Infrastructure | Air or immersion cooling to manage heat |

Security | Guards and cameras for protection |

Uptime and Redundancy | Backup systems for 95%+ uptime |

Internet Connectivity | Stable bandwidth for uninterrupted mining |

Regulatory Compliance | Follow local crypto laws and rules |

Regulatory Factors

Rules and laws affect every bitcoin mining operation. China banned mining because it used too much energy. This made miners move to other countries. Kazakhstan allows mining but taxes energy use. More demand could mean new limits later. The United States has different rules in each state. Some states give tax breaks and special help for crypto mining. El Salvador uses mining taxes to pay for green energy. This lowers costs and helps the planet. Iran sometimes bans mining and has strict licenses. This makes mining there risky.

Jurisdiction | Regulatory Factors Impacting Profitability | Description and Impact |

|---|---|---|

China | Energy restrictions, mining ban | Forced relocation, operational disruption |

Kazakhstan | Legalization, energy taxes | Attracts miners, risk of future restrictions |

United States | Federal oversight, state incentives | Tax breaks, regulatory complexity |

El Salvador | Green energy reinvestment | Lower costs, supports sustainability |

Iran | Temporary bans, licensing limits | Interruptions, uncertainty |

Tip: Miners who pick places with cheap, green energy and good rules build a stronger crypto portfolio and make more money over time.

Operational Efficiency

Monitoring and Maintenance

A good operational efficiency plan helps bitcoin mining hardware work well. Miners check their machines often to keep them safe and running. This helps protect their crypto and keeps mining going. They follow some simple steps to make ASIC miners last longer:

- Keep the room cool and dry. The best temperature is 20°C to 25°C. Humidity should be between 30% and 40%. Use fans to move air in and out.

- Blow dust off heat sinks and fans with air. This stops machines from getting too hot or breaking.

- Look at hardware for rust or loose wires. Make sure all cables are tight.

- Check cooling fans and change broken ones fast.

- Update firmware often to make machines safer and faster.

- Watch temperatures and power use with special tools.

- Use safe networks and firewalls to protect crypto. Back up settings to keep things safe.

- Big mining farms can hire experts to fix and check machines.

Tip: Doing regular checks helps stop problems and makes mining earn more money.

Expansion and Technology UpgradesScaling

Growing a crypto mining business needs a smart plan. Miners who make their sites bigger and get new machines do better. After each Bitcoin halving, miners who buy better hardware and try new tech keep making money. When energy prices go up, using good machines and clean energy helps miners save money.

Planning when to buy new hardware and try new tech keeps mining strong. Miners who learn fast and change with the market protect their crypto and help their business grow.

Financial and Regulatory Compliance

Budgeting

Big bitcoin mining companies need good budgeting. Teams make a budget for all costs. This includes hardware, energy, and facility bills. They check their cash flow every day. This makes sure they have enough money for mining. Investors use risk management to avoid big losses. They use dollar cost averaging and hedging. Many get loans backed by crypto. This lets them get cash without selling their bitcoin. When the market is good, they borrow safely to pay bills. In bad markets, they split mining rewards. Some rewards pay for costs. Others help grow hash power. This protects them if bitcoin prices drop.

Tip: Careful budgeting helps miners avoid money problems. It also helps them manage their portfolio for a long time.

Financial Risk Management

Big crypto miners face many money risks. The table below shows common risks and ways to fix them:

Financial Risk | Description | Mitigation Strategies |

|---|---|---|

Operational Risk | Hardware can break or get old. This causes downtime and repair bills. | Do regular checks, upgrade hardware, and work better. |

Electricity Cost Risk | Power prices can change and make mining cost more. | Use fixed-price power deals like Power Purchase Agreements (PPAs). |

Revenue Volatility (Hashprice Risk) | Network changes and bitcoin price changes affect earnings. | Sell hashrate to pools to keep earnings steady. |

Treasury Risk (Bitcoin Price Risk) | Holding bitcoin can be risky if prices change a lot. | Use hedging, or sell some bitcoin for cash. |

Network Difficulty Risk | Mining gets harder and lowers earnings. | Plan carefully and watch network changes to adjust. |

Miners often keep bitcoin as assets. But they owe money in regular currency. If prices crash, miners without hedging can go bankrupt. Hedging with futures or options helps. Selling some bitcoin for cash also helps. Rules and climate laws can change profits. Using green energy and following rules can lower these risks.

Regulatory Compliance

Big crypto miners must follow strict rules. They need licenses and must follow AML and KYC laws. These rules are different in each country. Japan needs a license and AML/KYC checks. The UK wants miners to save energy and report carbon use. In the US, rules change by state. Texas likes bitcoin mining. New York has more rules and wants miners to use green energy. Canada works with other countries on AML and has energy rules. Miners must know local laws to avoid trouble and keep mining legal.

Taxation and Reporting

Tax rules are different in every country. Miners must learn local tax laws to avoid fines. This helps them keep their portfolio clear and legal. In Germany, holding crypto for over a year means no capital gains tax. But mining rewards are taxed as income. Singapore does not tax capital gains for people. But businesses pay up to 22% tax on crypto income. Malta taxes mining as business income and has clear licenses. Switzerland uses progressive taxes for mining income and wealth. They also have clear rules for licenses. Keeping good records and reporting on time is important for following rules and managing risks.

Risk Management

Insurance

Big bitcoin mining businesses have many risks. Insurance helps protect them. Some companies use BTC-denominated insurance. This covers things like broken equipment, power loss, storms, and rule changes. These policies pay claims in Bitcoin. This helps miners get money fast and deal with price changes. Insurance helps miners fix problems quickly.

Hedging

Crypto mining can be risky because prices change a lot. Hedging is like insurance for investments. Miners use hedging to protect their money. The most common ways are options trading, futures contracts, diversification, and crypto structured products.

Options trading lets miners buy or sell Bitcoin at set prices. This helps limit losses if prices drop.

Futures contracts help miners set prices or balance losses. They can bet prices will go up or down to manage risk.

Diversification means owning other cryptocurrencies and stablecoins. If one goes down, another might go up.

Hedging helps miners plan better and keep their earnings steady. It lowers the risk from price swings. Miners who hedge can keep profits and avoid big losses. Good risk management makes mining safer and easier to predict.

ROI Optimization

Performance Tracking

Institutional crypto miners need to track how well they do. They watch important numbers to make sure their bitcoin mining works well. Some key numbers are hashrate per watt, power usage effectiveness (PUE), and equipment downtime. Hashrate per watt shows how much mining power comes from each unit of energy. PUE tells how well the facility uses energy, including cooling and other systems. Equipment downtime means how often machines stop working. Less downtime means more steady crypto output and more profit.

Metric Name | Definition | Industry Benchmark |

|---|---|---|

Hashrate per Watt | Mining power per unit of energy | Higher is better |

PUE | Total energy used vs. mining equipment energy | Closer to 1 is best |

Equipment Downtime | Time hardware is not operational | |

Net Profit Margin | Profit after all expenses |

Tip: Checking these numbers often helps teams find problems early and make their crypto mining better.

Benchmarking

Benchmarking helps miners see how they compare to others. They look at things like hash rate, energy cost for each coin, and net profit margin. By watching trends, miners know if their plan is working as well as others. Many join mining groups to share data and learn new things. Online tools now let miners see results right away. This helps everyone be honest and clear. These steps help miners keep a strong place in the crypto world.

Compare results to what is normal in the industry.

Use live data to change how things work.

Join mining groups to get advice.

Strategy Adjustment

They often upgrade to more efficient hardware, such as the Bitmain Antminer S21 or MicroBT Whatsminer M50, to maintain profitability. They also join mining pools, which is a more energy-efficient approach. Many use financial tools like futures and options to lower risk. Some mine other coins or do dual mining when things get tough. Teams watch bitcoin prices and network hash rate to see what might happen next. Knowing about mining difficulty cycles helps them get ready for changes. These steps help miners avoid risk and keep making money.

Get new hardware to work better.

Join mining pools to make income steadier.

Use green energy to save money.

Use financial tools to handle risk.

Mine different coins to spread out risk.

Institutional crypto investors get more ROI by picking efficient hardware, managing money carefully, and spreading out their investments in crypto and mining. The table below shows how top institutional crypto companies stay profitable. They do this by upgrading hardware, using cheaper energy, and managing their money well.

Aspect | Example from Institutional Crypto Firms |

|---|---|

Advanced ASICs improve cost efficiency and crypto output. | |

Energy Optimization | Low-cost, renewable energy reduces crypto mining expenses. |

Debt Reduction | Lower liabilities strengthen institutional crypto portfolios. |

Bitcoin Treasury | Large reserves provide stability for institutional crypto operations. |

Institutional crypto teams need to keep up with fast changes in the market and technology. They use real-time data, grow their business, and use energy better. Spreading out investments lowers risk and helps make more money. This means putting money into different assets, mining ways, and blockchain systems. Before growing bigger, institutional crypto leaders should talk to experts, test their plans, and try small projects to make sure their bitcoin mining ideas work.

FAQ

What is the most important factor for maximizing ROI in bitcoin mining?

Energy efficiency is the most important thing. Miners who pick efficient ASIC hardware and get cheap power make more money. Saving energy lowers costs and helps miners earn more profit.

How often should miners upgrade their hardware?

Miners should check their hardware every year or so. Upgrading after each Bitcoin halving or when better ASICs come out keeps mining strong. This helps miners stay ahead and make good profits.

What risks do large-scale miners face?

Big miners have many risks. Their hardware can break. Power prices can go up. Rules can change. Bitcoin prices can fall. Good risk management means having insurance, hedging, and spreading out investments.

How can miners reduce downtime?

Miners can stop downtime by doing regular checks. They should watch their machines and keep extra parts ready. Fixing problems fast keeps mining going without big stops.

Do miners need to report earnings for tax purposes?

Yes, miners must report what they earn and pay taxes. Most countries want miners to keep good records and report on time. This helps them avoid trouble with the law.

*Tip: Talk to a tax expert who knows crypto mining rules in your country.

Bitmain

Bitmain Iceriver

Iceriver

Bitdeer

Bitdeer BOMBAX

BOMBAX DragonBall

DragonBall Elphapex

Elphapex Fluminer

Fluminer Goldshell

Goldshell iBelink

iBelink Ipollo

Ipollo Jasminer

Jasminer Volcminer

Volcminer

Aleo Miner

Aleo Miner