Blog

In 2025, global markets have become increasingly volatile. Bitcoin briefly soared to $112,000 before retreating to $98,000 due to geopolitical tension, while gold hit an all-time high of $3,300 per ounce as investors turned to safe-haven assets. The question many investors are asking now is: which asset should you trust—Bitcoin or gold?

Macroeconomic Landscape: A Year of Uncertainty

With expectations of interest rate cuts on the horizon, investor behavior is shifting. However, in a world where markets are driven as much by perception as reality, even a rate cut may not be enough to offset underlying economic weaknesses. Instead, we are witnessing increased volatility in the stock market, and a growing appetite for safe-haven assets like gold and Bitcoin.

Gold: The Historic Safe Haven

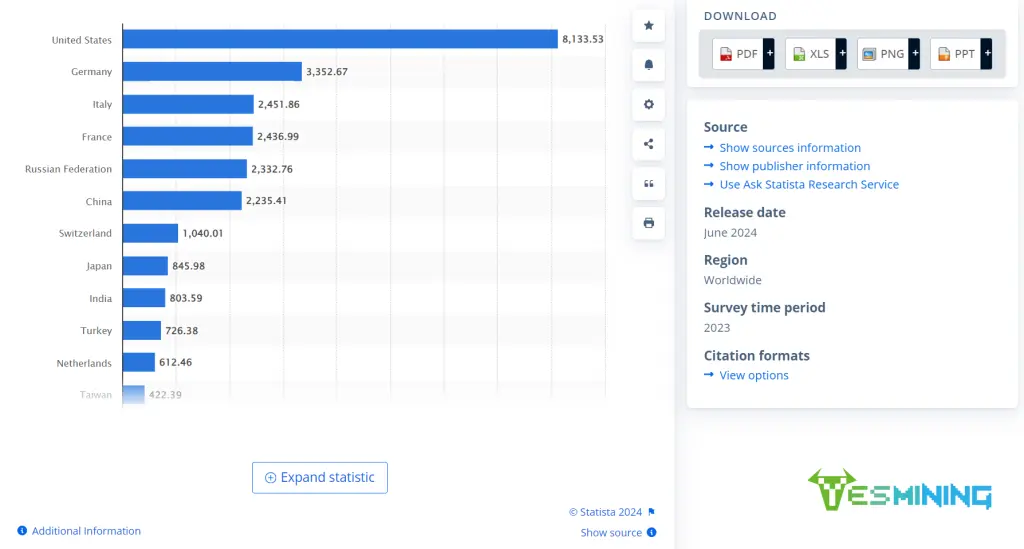

Gold has served as a store of value for centuries. While currencies are no longer backed by gold, central banks continue to accumulate reserves. The U.S. leads the world in gold holdings, with 8,133.46 tons—more than Germany, Italy, and France combined.

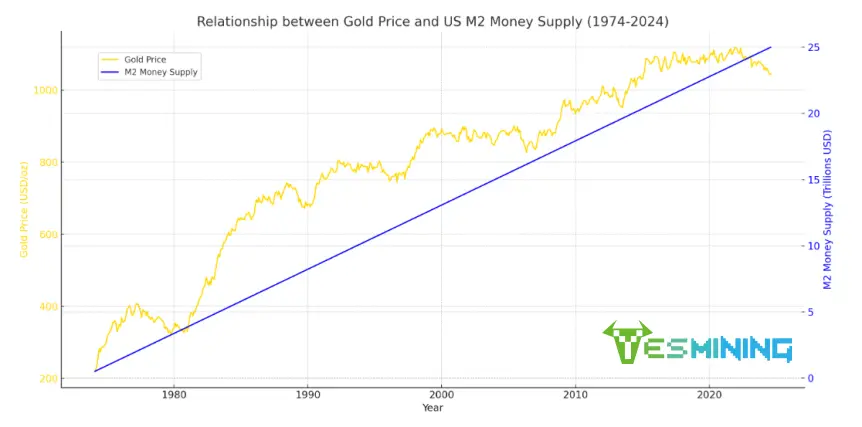

Historically, gold has tracked the expansion of U.S. dollar supply. Although the petrodollar system has supported the dollar’s dominance for decades, growing concerns about inflation and monetary policy have led countries to strengthen gold reserves.

Bitcoin: Digital Gold for the Modern Age

At the Bitcoin2024 Conference, Trump stated that Bitcoin could surpass the market cap of gold. While provocative, this reflects growing institutional interest. Following the 2024 approval of spot BTC ETFs, firms like BlackRock began accumulating Bitcoin, potentially using it as a strategic digital reserve asset.

Bitcoin shares key traits with gold—scarcity, durability, and global recognition. However, it brings unique advantages:

Fixed Supply: Only 21 million Bitcoin will ever exist.

Portability: Easily transferable globally.

Divisibility: Can be broken into satoshis.

Verifiability: Secured by blockchain.

These characteristics make Bitcoin a strong contender as a 21st-century store of value.

Bitcoin vs. Gold: Key Investment Comparisons

| Metric | Bitcoin (2025) | Gold (2025) |

| Price Peak | ~$112,000 | ~$3,300 |

| Volatility | High | Low |

| Supply | Fixed (21M) | Grows ~1.5%/year |

| Accessibility | Digital, borderless | Physical, centralized |

| Regulatory Risk | High | Low |

| Historical Trust | Since 2009 | Thousands of years |

How They Perform in Market Stress

During financial uncertainty, both assets tend to perform well—but differently:

Short-Term: Gold has historically offered more stability.

Long-Term: Bitcoin has shown stronger growth potential.

A study of 38 major market events since 2016 found that gold outperformed Bitcoin in the first 90 days, but Bitcoin delivered significantly higher returns over 1–2 years.

Investor Profiles: Which Asset Suits You?

| Investor Type | Best Fit |

| Risk-averse, long-term saver | Gold |

| Tech-savvy, risk-tolerant | Bitcoin |

| Seeking portfolio diversification | Both |

Younger investors and those familiar with digital assets may prefer Bitcoin. More conservative investors continue to view gold as a hedge against inflation and crisis.

ETF Adoption: A Historical Parallel

GLD (Gold ETF): Launched in 2004; took 2 years to cross $10B AUM.

IBIT (BlackRock’s Bitcoin ETF): Launched in 2024; hit $10B in 7 weeks.

This dramatic difference highlights the accelerating pace of digital asset adoption.

The Case for Diversification

Rather than choosing one over the other, a balanced portfolio may be the best strategy. Bitcoin offers exponential upside; gold offers resilience. Combining them helps mitigate risks while capturing potential growth.

| Time Horizon | Bitcoin Strength | Gold Strength |

| Short-Term | High growth potential | Capital preservation |

| Medium-Term | Performance in crises | Stability in downturns |

| Long-Term | Appreciation potential | Inflation protection |

Exploring the New Era of Bitcoin: Mining Opportunity

We are currently in a new and uncertain era for Bitcoin, and Bitcoin mining technology is evolving rapidly. If you’re interested in BTC mining, we have analyzed several top mining rigs. Among them, the Bitmain S21 Pro has proven its strong performance over time. In addition to the S21 Pro, newer models like the S21e XP Hyd and S21 XP are entering the market with enhanced features and improved energy efficiency, offering miners better options to maximize profitability. For comprehensive information, you can explore our blog post: 12 Best Crypto Mining Hardware Machines in 2024, or contact us directly for tailored mining rig recommendations based on your specific situation.

Don’t miss our latest crypto mining tips for 2025 to help you stay competitive in the next cycle.

Final Thoughts

In a world of uncertainty, both gold and Bitcoin offer unique advantages. While Bitcoin may offer higher growth, it comes with higher volatility. Gold remains the cornerstone of wealth preservation. Savvy investors should consider combining both to hedge risk and seize opportunity.

Disclaimer: This content is for educational purposes only and does not constitute financial advice.

Bitmain

Bitmain Iceriver

Iceriver

Bitdeer

Bitdeer BOMBAX

BOMBAX DragonBall

DragonBall Elphapex

Elphapex Fluminer

Fluminer Goldshell

Goldshell iBelink

iBelink Ipollo

Ipollo Jasminer

Jasminer Volcminer

Volcminer

Aleo Miner

Aleo Miner