Blog

Ethereum Investment is gaining attention from numerous investors. Its market value exceeds $533 billion, making it the second-largest cryptocurrency after Bitcoin.

Many people believe that Ethereum Investment has significant growth potential. However, there are risks involved as well. High transaction fees pose challenges for users. Fortunately, new Layer 2 platforms are emerging to help reduce these fees. Stablecoins and Layer 2 solutions could contribute to making Ethereum more stable in the future.

Ethereum Investment: Pros and Cons

Quick Overview

Ethereum Investment gets a lot of attention for its growth and special technology. In five years, Ethereum’s price went up by over 900%. Right now, it is close to $4,465. In the past year, the price grew by almost 76%. Ethereum had a big jump and went over $3,500, reaching $3,875 at its highest. Many people took out their Ethereum from exchanges, so there is less available now than since 2016. These facts show that Ethereum Investment can give big rewards.

Financial experts point out some good things and some risks. The table below shows the main ideas:

Advantage | Description |

|---|---|

Ethereum lets people use smart contracts and has many developers. This helps it support lots of digital assets and services. | |

Integration and disruption of traditional finance | Big banks use Ethereum for tokenization and settlement. This changes finance by making things faster and needing fewer middlemen. |

Risk Type | Description |

|---|---|

Ethereum's code changes a lot, which can cause tech problems. | |

Security Concerns | Staking could make ETH more centralized and less safe. |

Regulatory Uncertainty | New rules can make investors worry and bring new risks. |

Market Manipulation Risks | Crypto ETFs might be easier to trick or cheat. |

Key Factors

Many things affect how well Ethereum Investment does and what risks it has. The table below explains the most important ones:

Factor | Description |

|---|---|

Supply Mechanism | Ethereum can change how much ETH is made. Upgrades like EIP-1559 burn some ETH, which might make it deflationary and help prices go up. |

Market Demand and Use Cases | People use ETH for DeFi, NFTs, and metaverse apps. Ethereum has over 60% of the DeFi market, so more people need ETH for collateral and fees. |

Macroeconomics and Market Sentiment | The world economy and central banks affect Ethereum's price. Easy money rules can help risky assets, but bad news can make people sell. |

Technical Upgrades | Changes like the Merge and sharding make Ethereum faster and better, so more people want ETH. |

Laws and rules can help or hurt Ethereum Investment. ETF approvals can make more people buy, but strict rules can lower prices. |

Other important things are:

Market mood, which changes with news and social media.

Regulation, which depends on what governments decide.

Technology updates, like new protocol changes.

DeFi and NFT activity, which grows as more apps use Ethereum.

Competition from other blockchains.

Big economy factors, like inflation and interest rates.

Investors should also think about ETF risks:

If you only focus on Ethereum, prices can swing a lot.

New rules can quickly change how safe your investment is.

There are risks if you trust someone else to keep your assets safe.

What Is Ethereum?

Ethereum is a blockchain platform that enables digital asset transfer, app building, and value transmission. No single person or group controls it. The network is growing fast. Right now, more than half a million wallets are used every day.

Ethereum is a blockchain platform that enables digital asset transfer, app building, and value transmission. No single person or group controls it. The network is growing fast. Right now, more than half a million wallets are used every day.

Metric | Value |

|---|---|

Current Active Addresses | |

Active Addresses Yesterday | 636,776 |

Active Addresses One Year Ago | 454,553 |

Change from Yesterday | -13.29% |

Change from One Year Ago | 21.47% |

Unique Features

Ethereum is different from other blockchains. It has some special things that make it stand out.

Feature | Description |

|---|---|

Smart contracts run everywhere on the network. The rules always stay the same. No one can change them or control them. | |

Decentralized Applications | DApps work on a network of many computers. The data is open for everyone to see. No one can secretly change it. |

Ether (ETH) | Ether is used to pay for transactions and rewards. It stops people from sending too many fake transactions. |

Constant Evolution | Ethereum keeps getting better. Upgrades like Ethereum 2.0 help it work faster and safer. |

How Ethereum Works

Ethereum uses something called the Ethereum Virtual Machine, or EVM. The EVM runs smart contracts in a safe place. This keeps them away from the main network and computers. Once a smart contract is on Ethereum, it cannot be changed. Everyone checks the results to make sure they are right. The EVM keeps track of what happens on the blockchain. It also sets the rules for moving from one block to the next.

The EVM runs smart contracts in a safe area.

Smart contracts cannot be changed and are shared everywhere.

The EVM keeps the blockchain’s state by setting rules for new blocks.

Here is how Ethereum handles smart contracts:

The network turns smart contracts into code and saves them on the blockchain.

Each contract gets its own address. This comes from the creator’s address and how many times they have made contracts.

The EVM counts costs using gas units. People pay with ether to use the network.

Ethereum vs. Bitcoin

Ethereum and Bitcoin both use blockchain. But they do different things. Bitcoin is for sending and saving digital money. Ethereum lets people make programs and smart contracts. Bitcoin always has the same amount of coins. Ethereum can change how many coins it has. Ethereum gets new upgrades often. This makes it good for new ideas. Many investors like Ethereum Investment because it does more than just payments.

Note: Ethereum is special because it can run smart contracts and many apps. This makes it different from other blockchains.

Benefits of Ethereum Investment

Growth Potential

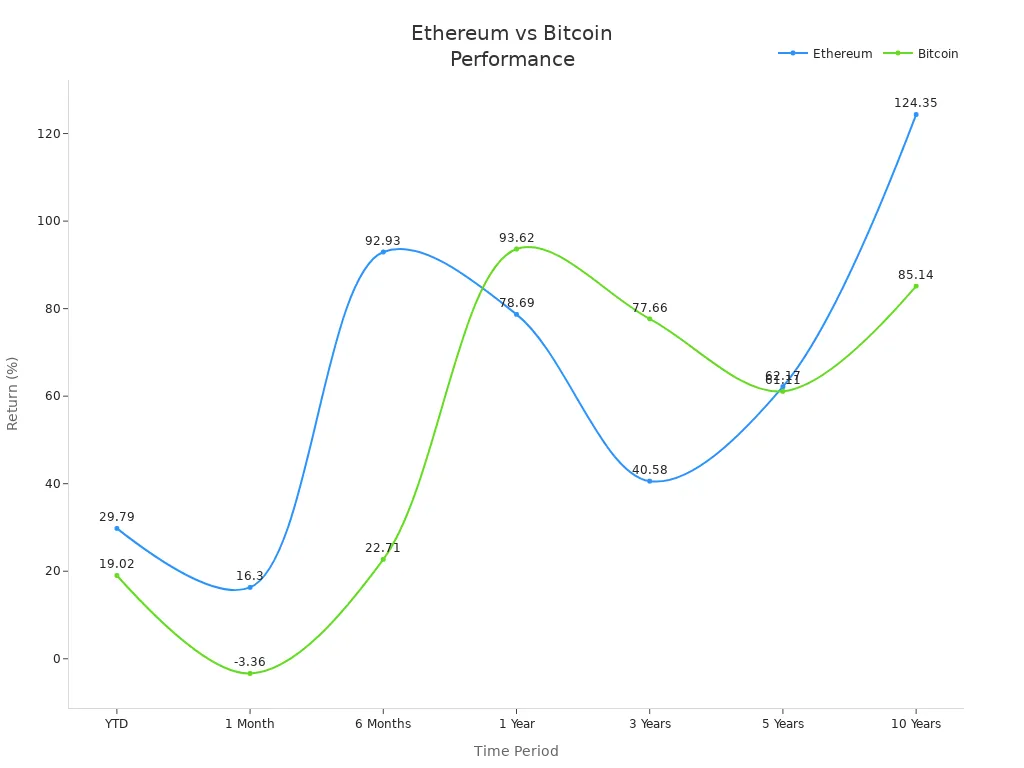

Ethereum Investment has grown a lot over the years. Many investors look at past returns to guess what might happen next. The table below shows how Ethereum did at different times:

In five years, Ethereum Investment gave a 60.84% return. This is better than most other cryptocurrencies. Many people think this means Ethereum can keep growing, even if it sometimes goes down in the short term.

Technology and Upgrades

Ethereum continues to evolve with new technological advancements, which enhance its speed and security. Key upgrades include:

Scalability: Enhances transaction processing capacity

Gas Fees Optimization: Reduces costs for users and developers

User Experience: Improves transaction speed and efficiency

Security Features: Strengthens resilience against exploits and bugs

Layer 2 Solutions: Enables faster transaction processing and lower fees

These upgrades make Ethereum more practical: better scalability supports more users and applications, lower gas fees reduce barriers to trying new tools, and improved security gives developers confidence to build new projects.

Tip: Upgrades like Layer 2 solutions benefit all Ethereum users by addressing key pain points (e.g., high fees, slow transactions).

Use Cases

Ethereum is used for many real-world things. These uses show how Ethereum Investment can help different businesses. The table below lists some popular ways people use it:

Use Case | Description |

|---|---|

Supply chain management | Tracks products and transactions, making it easier to trust where goods come from. |

Decentralized identity | Lets users control their own personal information securely. |

Gaming industry | Allows players to own and trade in-game assets as NFTs, creating new ways to earn money. |

Real estate tokenization | Enables fractional ownership of properties, making buying and selling real estate more transparent and liquid. |

Many companies use Ethereum to fix problems with payments, identity, and managing assets. These examples show why people are interested in Ethereum Investment and want to support new technology.

Risks of Ethereum Investment

Major Risks Overview

Investing in Ethereum has some big risks. People should know these before they invest.

1. Price Volatility

Ethereum’s price can go up and down fast. It often changes more than Bitcoin. The chart below shows how much Bitcoin’s price moves each year. Ethereum usually has even bigger changes.

2. Regulatory Uncertainty

Rules for cryptocurrencies change a lot.

In March 2025, the Treasury removed rules on Tornado Cash.

Sometimes, courts say tokens like XRP are not always securities for everyone, but rules can be different for big companies.

New laws or court choices can change Ethereum’s price and how people use it.

3. Cybersecurity Threats

Ethereum has had some big hacks.

In 2017, hackers took 153,000 ETH from the Parity wallet because of a bug.

The BunniXYZ hack caused a $2.3 million loss and showed DeFi apps can be risky.

These hacks show smart contracts and DeFi need strong safety. Weak spots can cause big money losses.

4. Competition from Other Blockchains

Ethereum has rivals like Solana and Cardano. Solana grows fast but stops working sometimes and is risky. Cardano is slow and might not keep up. Ethereum’s strong group and trust help, but other blockchains are still a threat.

5. Quantum Computing and Institutional Risks

Quantum computers could break today’s security in the future. Big investors also face problems like too many people using the same ETF and keeping assets safe. If lots of people use one ETF, prices can change even more.

Investors should always think about these risks before picking Ethereum.

Ethereum Investment vs. Other Assets

Bitcoin

Bitcoin and Ethereum are both top cryptocurrencies. They have different jobs. Bitcoin is used to save and send money safely. Ethereum lets people make smart contracts and apps. The table below shows how they are not the same:

Bitcoin | Ethereum | |

|---|---|---|

Purpose | Secure value transfer and storage | Programmable platform for Dapps and smart contracts |

Consensus Mechanism | Proof-of-Work (PoW) | Proof-of-Stake (PoS) |

Economic Model | Hard cap of 21 million BTC | No fixed cap, dynamic supply |

Scalability Approach | Off-chain solutions (e.g., Lightning) | On-chain upgrades and Layer-2 solutions |

Development Philosophy | Conservative, incremental changes | Flexible, ongoing upgrades |

Ethereum and Bitcoin do not always grow the same way. The table below shows how much money you could make with each one:

Metric | Ethereum (ETH) | Bitcoin (BTC) |

|---|---|---|

YTD | 29.79% | 19.02% |

1 Month | 16.30% | -3.36% |

6 Months | 92.93% | 22.71% |

1 Year | 78.69% | 93.62% |

3 Years | 40.58% | 77.66% |

5 Years | 62.17% | 61.11% |

10 Years | 124.35% | 85.14% |

Ethereum can give bigger gains in a short time. Bitcoin has done well over many years.

Ethereum can give bigger gains in a short time. Bitcoin has done well over many years.

Traditional Investments

People have picked stocks and bonds for a long time. Ethereum does not move the same way as these. Its connection to stocks and bonds is only about 38%. Stocks and bonds usually move together more, over 60%. This means Ethereum can help make your investments more mixed.

If you add a little Ethereum to your regular investments, you can lower risk and maybe get better results.

Studies say putting 5% in Bitcoin or Ethereum can raise the Sharpe Ratio, which shows how much you earn for the risk you take.

A normal mix of 60% stocks and 40% bonds could do better with some Ethereum. This helps balance risk and try for higher gains.

Note: Ethereum Investment can help make your investments more varied and might help you earn more.

Other Cryptocurrencies

Ethereum has rivals like Solana and Cardano. These also let people use smart contracts and apps. But Ethereum is special because it has many developers and gets new updates often. Solana is fast but sometimes stops working. Cardano takes its time and moves slowly.

Ethereum keeps its top spot by changing and growing. Many people pick Ethereum Investment because it has a big group and is used by lots of people.

Before You Invest

Risk Tolerance

Every investor should know how much risk they can handle. Some people are okay with big price changes. Others like slow and steady growth. You can use tools to find out your risk level. Setting clear limits helps you avoid big losses. Stop-loss orders can help you sell if prices drop too much. Checking the market and new rules often keeps you ready. Picking the right amount to invest can help control risk.

Tip: Ric Edelman, a famous financial advisor, now says people can put 10% to 40% of their money in cryptocurrencies like Ethereum. Before, he only suggested 1%. Everyone should choose what feels best for them.

Research

Smart investors always learn before they buy. They read expert reports from trusted companies like VanEck and Grayscale. These reports explain how Ethereum works and what is happening in the market. Looking at old price charts shows how Ethereum did before. It is important to know how news and world events change prices.

Investors should watch for new rules to avoid surprises.

Many new investors make mistakes by acting too fast or only looking at charts.

Joining Ethereum groups can give helpful tips and news.

Note: Learning more and asking questions can help you avoid common mistakes.

Diversification

Diversification means not putting all your money in one place. Adding Ethereum to your investments can help you earn more. Ethereum acts differently than stocks or bonds. Its special technology can bring new chances. If you only buy Ethereum, you might miss gains from other things.

Diversification can lower your risk and protect you from big losses.

Ethereum is different from Bitcoin and other assets, so it can help balance your investments.

Not having Ethereum could mean missing out on digital asset growth.

Remember: Investing in Ethereum is risky. Start with a small amount, be patient, and think about asking an expert before making big choices.

Ethereum has powerful technology and is used by many people. It could grow more in the future. But investors have to deal with prices that change a lot. There are also risks from people trying to trick the market and from new rules.

Experts say Ethereum’s smart contracts are very useful. More big companies are starting to use it.

Some problems are that a few people own a lot of Ethereum. Its price goes up and down even more than Bitcoin.

Money experts say you should not put all your money in one place. Talk to a professional and watch what is happening in the market.

All investments can lose money. People should learn as much as they can, start with a small amount, and pick plans that match their money goals.

FAQ

What makes Ethereum different from Bitcoin?

Bitcoin is mostly for sending money safely. Ethereum gets new technology updates often. Bitcoin always has the same number of coins. Many people build projects on Ethereum.

Is Ethereum safe to invest in?

Ethereum has risks like big price changes and hacks. New rules can also affect it. Investors should learn about these risks first. Using safe wallets and checking news can help keep your money safe.

How can someone buy Ethereum?

You can buy Ethereum on exchanges like Coinbase or Binance. First, make an account and put money in it. Then, pick how much Ethereum you want to buy. Keeping Ethereum in your own wallet is safer.

What are Layer 2 solutions?

Optimism and Arbitrum are examples of Layer 2. These upgrades make using Ethereum easier.

Can Ethereum be used for everyday purchases?

Some stores let you pay with Ethereum. Most people use Ethereum to invest or trade. Apps and wallets can help you spend Ethereum. But it is not as common as cash or cards.

Bitmain

Bitmain Iceriver

Iceriver

Bitdeer

Bitdeer BOMBAX

BOMBAX DragonBall

DragonBall Elphapex

Elphapex Fluminer

Fluminer Goldshell

Goldshell iBelink

iBelink Ipollo

Ipollo Jasminer

Jasminer Volcminer

Volcminer

Aleo Miner

Aleo Miner