Blog

Table of Contents

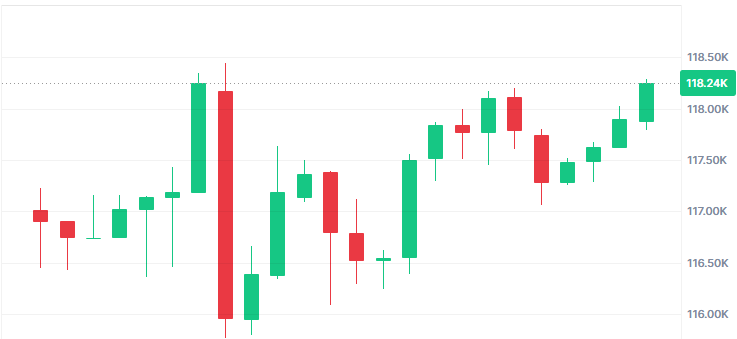

Trump Media Co.’s $2 billion investment and pro-crypto policies have triggered a surge in the bitcoin price high, pushing btc above $120K. Strong institutional demand, increased crypto trading, and ongoing btc accumulation have fueled sustained momentum.

The table below highlights institutional moves driving crypto market excitement:

Metric/Entity | Value/Description |

|---|---|

$2 billion worth of Bitcoin and related securities | |

Tesla Bitcoin Holdings | Approximately $1.35 billion worth of Bitcoin |

Bitcoin Price High | $123,218 (recent all-time high) |

Bitcoin Current Trading | Around $118,000, consolidating above $116,000 |

Trump Media Additional Funds | $300 million set aside for Bitcoin-related options |

Institutional Confidence | US-listed spot Bitcoin ETFs recorded $2.39 billion weekly inflows |

Key Takeaways

Strong institutional demand and record ETF inflows are driving Bitcoin’s price above $120K by reducing supply and boosting market confidence.

Large Bitcoin holders, or whales, actively accumulate and consolidate assets, signaling strong market stability and long-term investor trust.

Supportive U.S. policies and shrinking Bitcoin supply on exchanges create a favorable environment that sustains upward price momentum.

Bitcoin’s Price Drivers

Institutional Adoption

Institutional adoption continues to be the primary driver behind Bitcoin’s price surge following a week of steady gains. Major financial institutions, corporations, and even government entities have increased their exposure to bitcoin.

Record-breaking ETF inflows have played a crucial role in the current rally. Spot Bitcoin ETFs, especially BlackRock’s IBIT, have seen cumulative net inflows exceeding $54.75 billion by mid-July 2025. IBIT alone holds over $80 billion in assets, making it the fastest-growing ETF in financial history. On July 10, 2025, spot Bitcoin ETFs recorded $1.18 billion in inflows, with IBIT leading at $448.5 million. These inflows often precede major Bitcoin rallies by one to two weeks, acting as a leading indicator for price surges.

The following table highlights recent examples of this trend:

Institutional Segment | Metric/Example | Details |

|---|---|---|

Institutional Investors | Portfolio Allocations | 59% of institutional investors allocate at least 10% of portfolios to Bitcoin and digital assets by Q2 2025. |

Spot Bitcoin ETFs | Assets Under Management (AUM) | Over $65 billion globally by April 2025, driven by regulated, low-friction access products. |

BlackRock iShares Bitcoin Trust | AUM and Market Position | Over $18 billion AUM by Q1 2025, dominating the Spot Bitcoin ETF market. |

Corporate Treasuries | Adoption Trend | Increasing number and size of Bitcoin holdings in corporate treasuries throughout late 2024 and 2025. |

Sovereign Wealth Funds | Strategic Accumulation | Quiet but significant Bitcoin accumulation as a hedge against geopolitical and monetary risks, reshaping market structure. |

Financial giants like BlackRock and Fidelity have expanded their Bitcoin ETF offerings, while Wall Street banks including Goldman Sachs and JPMorgan Chase now provide institutional-grade trading and custody services. This broadening participation has led to a structural supply squeeze, with persistent net absorption across diverse holders bolstering long-term price support.

The institutional footprint is further evidenced by a 9% rise in liquid Bitcoin balances (Jan-Apr 2025) and consolidated ETF flows. While increased trading volume and profit-taking reflect active position management, the overall effect has been net accumulation—enhancing both market liquidity and upward momentum as institutions increasingly shape Bitcoin’s price discovery.

Retail Demand & FOMO

Retail investors continue to play a crucial role in driving bitcoin’s price. FOMO, or fear of missing out, often leads to impulsive buying during price surges. Social media platforms like Twitter, Reddit, and TikTok amplify this effect by spreading hype and bullish predictions. Viral posts and influencer tweets can trigger rapid buying sprees, especially after major institutional announcements.

FOMO causes many retail investors to buy at market peaks, which can lead to sharp corrections.

Bitcoin’s volatility creates an emotional cycle, where FOMO-driven investors buy high and sell low.

Historical examples, such as the 2017 and 2021 bull runs, show that FOMO-driven buying often precedes significant price corrections. The perception of bitcoin as “digital gold” and growing institutional adoption further intensify retail demand.

Supply & Halving

Bitcoin’s fixed supply and halving events are fundamental to its price dynamics. The most recent halving on April 19, 2024, reduced the block reward from 6.25 BTC to 3.125 BTC, cutting daily new issuance from about 900 BTC to 450 BTC. With approximately 94% of all bitcoin already mined, new issuance now represents a smaller fraction of the total supply.

Each halving event reduces the number of new coins entering circulation by 50%. This scarcity-driven mechanism supports bitcoin’s deflationary nature and reduces sell-side pressure from miners. The halving is hard-coded to occur every 210,000 blocks, capping total supply at 21 million BTC.

Historically, halvings create a supply shock that often precedes extended bull markets. After the 2020 halving, bitcoin experienced a parabolic rally, and similar patterns followed the 2016 and 2012 events. While price effects are not guaranteed, the reduction in new supply typically tightens the exchange float and influences market sentiment.

Macroeconomic Impact

Bitcoin’s price surges in 2024 and early 2025 are closely linked to global economic uncertainty, including tariff-related inflation and equity market volatility. For example, while the S&P 500 declined by 8% in Q2 2025, bitcoin outperformed with a 22% increase. Institutional inflows and holdings by major firms reflect growing confidence in bitcoin as a long-term store of value.

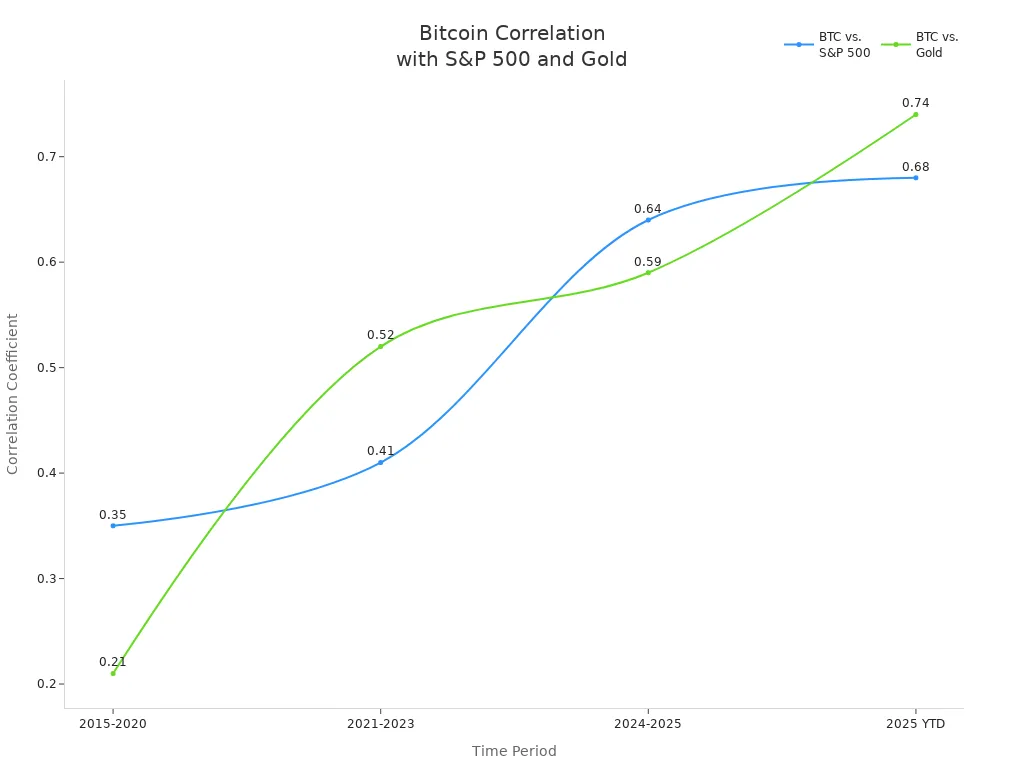

The correlation between bitcoin and traditional assets has increased, especially during periods of macroeconomic stress. Bitcoin’s rising correlation with gold in 2025 suggests it is increasingly seen as a digital safe haven, while its alignment with equities indicates deeper integration into mainstream finance.

Regulation & ETFs

‘Bitcoin is showing why it’s in a class of its own,’ commented OKX CEO, as institutional adoption through ETFs reinforces its role as a hedge against inflation and instability.

This legitimacy stems partly from a transformative U.S. policy shift:

Recent legislative actions have created a regulatory springboard for Bitcoin. During “Crypto Week” in Congress, lawmakers advanced pivotal bills:

- GENIUS

- CLARITY Acts

- Concrete policy milestones further accelerated institutional adoption:

Date | Development | Description |

|---|---|---|

Mar 6, 2025 | Executive Order: Strategic Bitcoin Reserve | Treasury holds BTC as government assets, not for sale. |

Apr 10, 2025 | Congressional Joint Resolution (H.J.Res.25) | IRS must remove the ‘broker rule’ for digital asset sales. |

Jul 11, 2025 | IRS and Treasury Removal of Crypto Broker Tax Rule | DeFi exchanges and some crypto providers exempt from strict tax reporting. |

Jun 25, 2025 | FHFA Directive to Fannie Mae and Freddie Mac | Crypto now counts as eligible asset for mortgage reserves. |

These regulatory breakthroughs directly fueled the ETF ecosystem. Following BlackRock’s spot ETF launch, Bitcoin surged 47% in Q2 2025 alone. The $54.75B cumulative ETF inflows (as of mid-July 2025) now dominate price discovery:

Bitcoin ETF inflows increase market liquidity, allowing large trades with minimal price impact and reducing volatility. Outflows, on the other hand, can lead to higher volatility and more disruptive price movements. BlackRock’s IBIT ETF now dominates the market, creating a liquidity loop that tightens spreads and enhances price discovery.

The combination of regulatory clarity, ETF-driven adoption, and increased liquidity has positioned bitcoin as a core asset in the global financial system. These factors continue to drive the current bull market and support the ongoing uptrend.

Bull Market Trends

Bitcoin’s current rally shows unique characteristics compared to past cycles, with shallower drawdowns (<25%) and lower volatility as institutional participation grows. On-chain data confirms strong fundamentals: exchange reserves continue declining while long-term holder balances reach new highs, reflecting sustained accumulation. If this cycle follows historical patterns, prices could potentially target $260,000—though the market’s growing maturity suggests more measured growth than previous bull runs.

Market sentiment remains cautiously optimistic, fueled by record ETF inflows and improving infrastructure. However, analysts warn that while corrections may occur, the combination of institutional adoption, supply scarcity from the halving, and macroeconomic uncertainty creates a strong foundation for Bitcoin’s long-term uptrend.

Cycle Comparisons

Bitcoin’s current bull market stands out for its duration and structure. The cycle began in late 2022 and has lasted just over two years, making it comparable to the 2017 and 2021 cycles. However, the price appreciation so far is lower than in previous cycles. The table below shows how the current cycle compares to earlier ones:

Cycle Year | Duration (years) | Price Appreciation (x) | Notes |

|---|---|---|---|

2017 | Just under 3 | >100 | Longest and highest magnitude among recent cycles |

2021 | Just under 3 | ~20 | Moderate duration and magnitude |

Current (2022-) | Just over 2 | ~6 | Shorter duration so far, lower magnitude, but may extend further |

If the current bitcoin bull market matches the growth of 2017, the peak price could reach $260,000. Matching the 2013 cycle would mean a possible peak near $858,000. This shows that the current uptrend still has room to grow.

Several key differences mark this cycle:

Realized volatility averages below 50%, much lower than the 80%-100% seen in past cycles.

Drawdowns are shallower, usually less than 25% from local highs, compared to 30%-50% in earlier cycles.

Institutional investors, especially through ETFs, now play a larger role, bringing more liquidity and stability.

The market structure has matured, with capital rotating from long-term holders to new investors, supporting steady price momentum.

The current cycle also shares similarities with the 2015–2018 period, such as drawdown profiles and realized cap changes. However, the rate of price appreciation has declined with each cycle, showing that the market is maturing.

Market Sentiment

Market sentiment plays a crucial role in bitcoin’s price movements. Positive sentiment and media coverage sustain the current rally, with news of regulatory progress like the GENIUS Act and IRS rule changes driving bitcoin near $120,000. Technical indicators and bullish analyst forecasts support continued buying momentum.

Key sentiment gauges show:

- The Crypto Fear and Greed Index remains in “Greed” territory.

- Social media analysis reveals 83% positive sentiment on major platforms.

- Futures premium rates indicate strong bullish positioning.

Expert consensus reinforces optimism:

Expert predictions for bitcoin’s price top and bull market duration have evolved with recent developments. Analysts see strong momentum from ETF inflows and bullish technical patterns. Near-term price targets range around $160,000, with some long-term forecasts as high as $500,000. Veteran trader Peter Brandt identifies a bullish “flag” breakout pattern, suggesting a rally to $135,000 before a possible correction. Crypto analyst Willy Woo believes bitcoin is entering the late phase of its bull market, with diminishing momentum and increased sensitivity to macroeconomic factors. Many experts expect a bull market peak around October 2025, followed by a correction phase. The overall sentiment remains cautiously optimistic, balancing strong technicals and institutional inflows with concerns about market maturity and external risks.

Notably, three interconnected drivers fuel the rally: institutional adoption, ETF inflows, and the recent halving.

This combination creates a self-reinforcing cycle where institutional demand accelerates price discovery while shrinking exchange reserves. As the next halving approaches, early miners strategically position to maximize returns during supply-constrained periods.

Investors should monitor technical levels and sentiment shifts, though the current balance of institutional adoption, ETF flows, and macroeconomic support suggests sustained upward momentum.

FAQ

What makes this bitcoin bull market different from previous cycles?

Institutional adoption, ETF inflows, and improved regulation set this bull market apart. These factors create more stability and attract larger investors.

What risks should investors watch during a bitcoin bull market?

Volatility remains high.

Regulatory changes can impact prices.

Market sentiment shifts quickly.

Investors should monitor technical signals and news.

What role do bitcoin ETFs play in price movements?

Bitcoin ETFs provide regulated access for institutions. They increase liquidity and help stabilize prices. ETF inflows often signal strong market confidence.

Bitdeer

Bitdeer Bitmain

Bitmain BOMBAX

BOMBAX DragonBall

DragonBall Elphapex

Elphapex Fluminer

Fluminer Goldshell

Goldshell iBelink

iBelink Iceriver

Iceriver Ipollo

Ipollo Jasminer

Jasminer Volcminer

Volcminer Aleo Miner

Aleo Miner