Blog

Money has always been a core global conversation, and cryptocurrency has reshaped that conversation entirely. Once a niche tech concept, crypto is now mainstream: a decentralized digital asset powered by blockchain, trusted for transparency and inflation protection, with no government control.

Yet as more people dip their toes into crypto, whether holding Bitcoin, Ethereum, or other tokens, a critical question keeps popping up. How does crypto really differ from the fiat currency (dollars, euros, yen) we’ve relied on for decades? And beyond just differences, how does crypto’s design—from fixed supply to peer-to-peer transactions—help protect and grow users’ funds?

In this blog, we’ll compare them across key areas of control, value, and transactions to answer that.

Key Takeaways

- Cryptocurrency is digital money. It does not have government control. You can use it for fast transactions. It is secure and works worldwide.

- Fiat currency is money from the government. Examples are dollars or euros. Many people use it. It keeps its value steady.

- Pick a cryptocurrency for quick payments. It also gives you privacy. Use fiat if you want a trusted way to pay.

- Both types have risks. Cryptocurrency can change in value quickly. It has fewer rules. Fiat is usually safer. But inflation can change its value.

- Think about what you need before you choose. Use fiat for daily shopping. Use cryptocurrency for online payments. It is good for sending money to other countries.

Cryptocurrency vs Fiat Currency

What is Cryptocurrency?

People talk about cryptocurrency a lot. It is a kind of digital money. You can only use it online. You cannot touch it like coins or bills. You keep it in a digital wallet. Bitcoin is the most well-known example. It started in 2009. People use cryptocurrency to buy things and save money. It is also used to measure value. Cryptocurrency does not have a physical form. It does not need banks or governments.

Cryptocurrency works with blockchain technology. Every transaction is recorded on a public ledger. Anyone can check this ledger. Payments are fast and secure. You can send money anywhere in the world. You can do this any time, even on weekends. Most cryptocurrencies have a set supply. No one can make more whenever they want. This makes them different from other digital currencies.

Some features make cryptocurrency special:

- Transactions are secure and encrypted.

- You can send money directly to others.

- You can use it any time.

- Your information stays private.

- Transactions cannot be undone.

Cryptocurrency was made so you can send money without banks.

There are many types of digital currency in crypto. Stablecoins are linked to the U.S. dollar or other currencies. Bitcoin and Ethereum change price with supply and demand. Crypto assets include cryptocurrencies, crypto tokens, and crypto commodities.

What is Fiat Currency?

Fiat currency is the money used daily, such as US dollars, EUR, and CNY. Governments issue and regulate it. You can hold it as cash or use it digitally via banks. It has no backing from gold or silver; its value comes from trust in the government or central bank. It applies to wide scenarios, is easy to carry, and governments and banks adjust their supply to stabilize prices, making it reliable.

On August 15, 1971, the U.S. dollar stopped being tied to gold. This ended the Bretton Woods system. It started a new time with fiat currencies.

Comparing Core Features

Here is a table to show the main differences:

| Feature | Cryptocurrency | Fiat Currency |

|---|---|---|

| Nature | Decentralized, digital currency | Centralized, government-issued currency |

| Transaction Speed | Fast, 24/7, global | Slower, limited by banking hours |

| Transaction Fees | Lower, fewer intermediaries | Higher, banks, and other fees |

| Acceptance | Growing, not universal | Widely accepted everywhere |

| Stability | High volatility | More stable and predictable |

| Transparency | High, blockchain records all transactions | Varies, less transparent |

| Consumer Familiarity | Less familiar, needs learning | Highly familiar and trusted |

| Regulatory Framework | Evolving varies by country | Well-defined, regulated by governments |

| Integration with Financial Systems | Needs special tools and knowledge | Easily fits into existing systems |

Advantages and Disadvantages

Both cryptocurrency and fiat have good and bad sides.

- Advantages of Cryptocurrency:

- Transactions are fast and easy.

- You can see all transactions.

- You can reach global markets.

- Fewer middlemen.

- New ways to pay.

- Prices can go up.

- Smart contracts can automate things.

- Disadvantages of Cryptocurrency:

- Rules are not clear.

- Prices change a lot.

- Not everyone accepts it.

- Cybersecurity problems.

- It can be hard to use.

- Tax and accounting are tricky.

- Many people do not know how to use it.

- Advantages of Fiat Currency:

- Accepted almost everywhere.

- Value is steady and predictable.

- Works with current financial systems.

- Clear rules and laws.

- Easy to use and learn.

- Most people trust it.

When you look at cryptocurrency vs fiat currency, you see that cryptocurrency is fast and open. It works everywhere. Fiat currency is steady and trusted. It is accepted in most places. You should choose what fits your needs best.

Difference Between Fiat and Cryptocurrency

Centralization vs Decentralization

Fiat and cryptocurrency are different because of who controls them. Fiat currency is run by central authorities. These are governments or central banks. They decide how much money there is. They also make the rules for using it. People trust these groups to keep money safe and steady.

Cryptocurrency is not run by one group or person. Many computers, called nodes, work together to keep it going. These nodes follow special rules called consensus algorithms. These rules help everyone agree on each transaction. This stops cheating or changing records. You do not need to trust a bank or government. You trust the system and the math.

Here is a table to show how they compare:

| Mechanism | Fiat Currency | Cryptocurrency |

|---|---|---|

| Control | Central authorities (governments, banks) | Decentralized network of nodes |

| Money Supply | Controlled by central authorities | Governed by consensus mechanisms |

| Regulation | Subject to government policies | Operates independently of government |

| Security | Backed by national authority | Secured by cryptography and algorithms |

Tip: Central banks can change fiat rules anytime. With cryptocurrency, rules only change if most users agree.

You may wonder how cryptocurrencies stay fair. Consensus algorithms help all computers agree on what is true. These rules stop anyone from taking over the system. They also keep your transactions safe and honest. You do not have to worry about one group having too much power.

- Central authorities issue and control fiat currencies. They decide money supply and interest rates.

- Cryptocurrencies use blockchain technology. This lets everyone check and record each transaction.

- Central authorities can change money rules. Cryptocurrencies use consensus rules to stop this.

When you compare fiat and cryptocurrency, you see a big difference. Fiat needs trust in leaders. Cryptocurrency needs trust in technology and the network.

Supply and Creation

There is also a big difference in how new money is made. Central banks create fiat currency in many ways. They use open market operations, set interest rates, and change reserve rules. Sometimes, they use quantitative easing to add more money. These tools help them fix problems like inflation or recession.

- Open Market Operations: Central banks buy or sell government bonds. This changes how much money is in the system.

- Interest Rates: They set how much it costs to borrow money. This changes how much people spend or save.

- Reserve Requirements: Banks must keep some money in reserve. This controls how much they can lend.

- Quantitative Easing: Central banks buy assets to put more money into the economy.

Fiat is flexible. Central banks can print more money if needed. This helps manage the economy. But printing too much can cause inflation.

Cryptocurrency works differently. Most cryptocurrencies, like Bitcoin, have a fixed supply. No one can just make more coins. For example, Bitcoin will only have 21 million coins. The network gives out new coins at a set rate. This rate drops over time. This is called “halving.” Each halving means fewer new coins are made. This makes coins more rare.

| Halving Year | Price Increase (%) | Event Description |

|---|---|---|

| 2012 | 8000 | The first halving led to a significant price surge |

| 2016 | 300 | The second halving preceded a major price rise |

| 2020 | 600 | The third halving resulted in a substantial price increase |

- Bitcoin’s supply is limited to 21 million coins.

- Halving events lower the rate of new Bitcoin. This makes each coin worth more.

- Past halvings have caused big price jumps.

Scarcity is built into many cryptocurrencies. This is not true for fiat, where supply can change fast. If you want a currency that cannot be printed at will, you might like crypto. If you want a currency that can change with the economy, fiat may be better.

Fiat vs Crypto: Value and Stability

Price Volatility

When you look at fiat and crypto, you see price changes. Fiat currency prices do not move much each day. You can expect dollars or euros to keep their value. Cryptocurrency prices change a lot more. Bitcoin and Ethereum can go up or down very fast. This is because the crypto market is still young. Many people guess what each coin should cost.

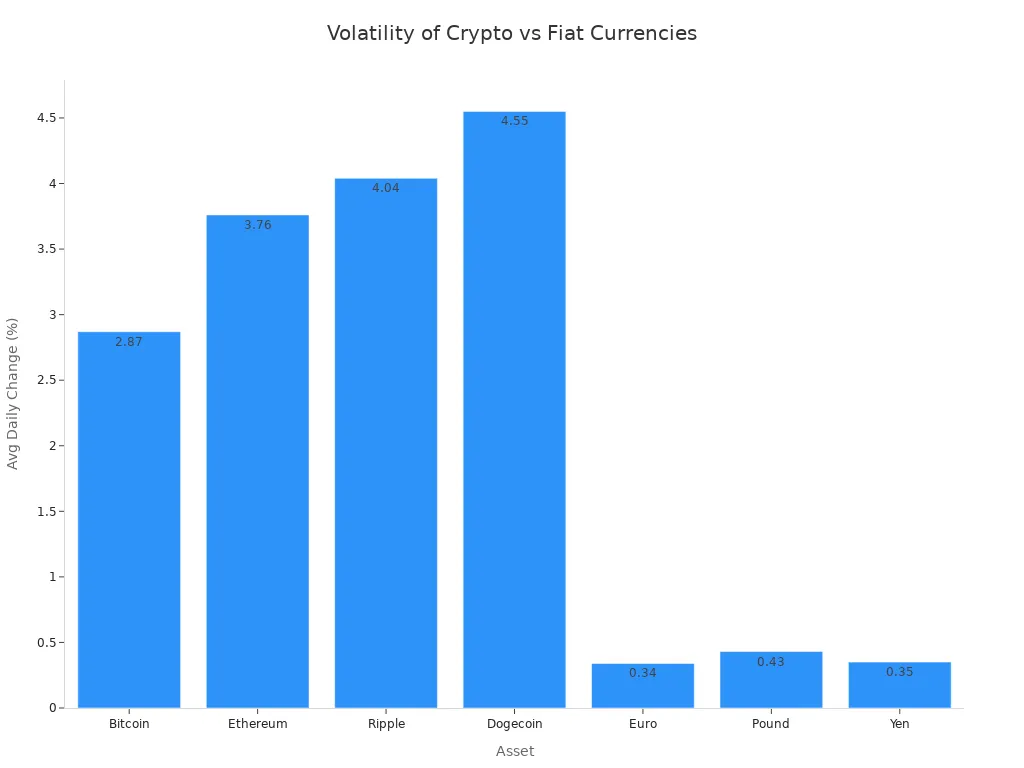

Check this table to see how much prices move:

You can see crypto prices move more than fiat. Crypto trades all day and night. There are no breaks or weekends. This makes prices change quickly. There are not many rules for crypto. News and events can make prices jump.

- People are still figuring out crypto prices.

- Not many rules means more risk.

- Trading never stops, so prices move fast.

Sometimes, people use cryptocurrency to save money when things are bad. But crypto can also lose value quickly if there is trouble. Stablecoins try to fix this by matching their value to fiat. You can use stablecoins if you want less risk.

Government Backing

Fiat currency is strong because of government support. You know dollars and euros are real money. Stores have to take them. Governments make rules to keep fiat safe. Central banks decide how much money there is. They use rules to stop prices from rising too fast.

Here is a table that shows how governments help fiat:

| Evidence Supporting the Stability of Fiat Currencies | Description |

|---|---|

| Legal Tender Laws | Governments say fiat must be accepted for payments and debts. |

| Regulation of Financial Systems | Governments make rules to stop big problems in the economy. |

| Central Bank Policies | Central banks control money to keep its value steady. |

You trust fiat because the government protects it. If a country prints too much money, problems can happen. Sometimes, fiat loses value quickly. But most of the time, rules keep fiat strong.

Cryptocurrency does not have help from the government. Its value depends on what people want to pay. You trust the market, not a bank. Stablecoins help by linking their price to fiat. Some stablecoins use dollars or euros to back them. These stablecoins make people feel safer. You might pick crypto for freedom and new ideas. You might pick fiat for safety and trust.

Tip: Stablecoins give you less risk than other cryptocurrencies. They are steadier, like fiat.

Security and Privacy

Crypto Security

Using cryptocurrency brings special security problems. Hackers try to break into digital wallets and exchanges. They want to steal your money. Phishing tricks you into giving away your passwords or private keys. Smart contracts can have mistakes. Attackers use these mistakes to take money. Scams use social engineering to get your secret information. People inside companies can also be a danger. They might use their access in the wrong way. Physical threats are rising. Some people face kidnapping or home invasions because they own crypto.

| Security Threats | Description |

|---|---|

| Hacking | Breaking into wallets or exchanges to steal money. |

| Phishing | Fake websites try to get your secret info. |

| Smart Contract Vulnerabilities | Mistakes in smart contracts that attackers can use. |

| Social Engineering Scams | Tricks to make you share secret information. |

| Insider Threats | People inside companies use their access wrongly. |

| Physical Risks | Kidnapping or home invasions for crypto owners. |

Blockchain helps keep your transactions safe. Cryptography makes each transaction secure and hard to change. Consensus rules let many computers agree on each transaction. This stops cheating. Decentralized systems mean no single person controls everything. This makes it harder for attackers to win.

Tip: Use strong passwords and turn on two-factor authentication for your crypto accounts.

Fiat Security

Banks and financial companies protect your fiat money. They use many security steps to keep your accounts safe. Dual control means more than one person must approve big transfers. Multi-factor authentication adds extra steps before you can use your account. Multi-person approval helps stop mistakes or fraud for large transactions. Banks test their systems often to find and fix problems. They have plans to handle security issues fast.

| Security Measure | Description |

|---|---|

| Dual control and verification | More than one person must approve big transfers. |

| Multi-factor authentication | Extra steps to keep accounts and transactions safe. |

| Multi-person approval workflows | Needed for big transfers to stop mistakes. |

| Regular penetration tests | Banks check for weak spots in their systems. |

| Incident response plan | Plans to fix problems quickly if something goes wrong. |

Banks follow strict rules to protect your money. Federal law says banks must give you privacy notices when you open an account. They must also send these notices every year. These notices tell you what personal information banks collect. They explain how banks share and protect your information.

Privacy Aspects

Crypto and fiat transactions give you different privacy levels. Crypto transactions often hide your identity. Your personal details are not linked to each transaction. Privacy coins keep your financial details even more secret. You use fake names instead of your real name. This gives you extra privacy.

Fiat transactions use your real name and other personal details. Banks must follow laws like the Gramm-Leach-Bliley Act and the Fair Credit Reporting Act. These laws say banks must tell you how they use your information. You can choose to stop some sharing.

Federal law says banks and financial companies must give privacy notices when you open an account and every year. These notices tell you what information is collected, how it is shared, and how it is protected.

Remember, cryptocurrency is not always fully private. Sometimes, third parties can track your transactions. This depends on the type of crypto you use. Always check the privacy features before you use any currency.

Regulation and Legal Status

Fiat use follows your country’s specific rules—these laws govern banks, payments, and money movement, with central banks overseeing the system to ensure safety and trust.

Crypto regulation varies globally: some countries (e.g., El Salvador, Central African Republic) accept crypto as money, while others (e.g., China) ban it entirely. Your crypto experience depends on your location.

Key Regional Crypto Rules:

| Region | Regulation/Action | Description |

|---|---|---|

| USA | SEC Guidance | The SEC is making rules for cryptocurrencies. They want to know if crypto is like stocks or commodities. |

| USA | OCC Interpretive Letter | Banks can now keep crypto safe for users. |

| USA | State Regulations | States like New York and Oklahoma have their own crypto laws. |

| EU | MiCA Regulation | The EU made new rules for all crypto assets. |

| Global | IMF and FSB Involvement | International groups are making plans to manage crypto risks. |

Other examples: The US classifies some crypto as securities; the EU’s rules protect users and fight money laundering; Singapore uses licenses for digital tokens; Japan/Switzerland have special crypto laws. There’s no global crypto rulebook yet.

Note: Always check local laws first—rules change fast. For a deeper dive into global crypto regulatory updates, see this guide.

Acceptance and Use

More places accept cryptocurrency each year. Big companies now let you pay with digital coins for everyday items like coffee, clothes, or even cars, showing they trust this new payment method and want to offer more choices.

Famous names that take crypto include PayPal, Microsoft, Tesla, Starbucks, Whole Foods, and select Gucci stores. Netflix is also testing crypto payments in early 2025. There are even special events like Base’s OCS Coffee Days, where you can pay with crypto too.

These examples prove crypto isn’t a fad—it’s becoming part of daily life.

Many companies use crypto payments because they are fast. The fees are also lower than with fiat money.

Fiat is still the main way to pay in most stores. People use cash, credit cards, or bank transfers for most things. Crypto is growing, but it is not as common as fiat yet. Most people feel safe with fiat. It is familiar and trusted.

In some countries, local money is weak. People use Bitcoin and other cryptocurrencies more often there. You see this in big peer-to-peer exchanges. Crypto helps when fiat loses value or is unstable. This can bring risks to the economy. But it also gives people new ways to pay.

Here is a quick comparison:

| Payment Type | Acceptance Level | Speed | Fees | Use in Emerging Markets |

|---|---|---|---|---|

| Fiat | Very high | Medium | Higher | Main choice |

| Crypto | Growing | Fast | Lower | Increasing |

You have more ways to pay than ever before. Crypto payments are getting easier, but fiat is still used most around the world.

Risk and Challenges

When you use cryptocurrency or fiat, you face different risks. You should know these risks before you choose what to use.

Cryptocurrency has new risks. Hackers can attack exchanges and wallets. You could lose your money if this happens. Rules for crypto change a lot in some countries. Your favorite coin might get banned or restricted. The price of cryptocurrency can change very fast. You could make money or lose it quickly.

Consumer protection is important to think about. Cryptocurrency does not have strong rules yet. Scams and fraud happen often. You may not know what to do if something goes wrong. Many people find cryptocurrency hard to understand. Not knowing much makes it tough for new users. If you do not know how wallets or exchanges work, you might make mistakes.

Here is a table that shows the main risks for both types of money:

| Risk Type | Cryptocurrency | Fiat |

|---|---|---|

| Hacking | High risk for wallets and exchanges | Lower risk, banks protect accounts |

| Regulation | Unclear, changes often | Stable, well-defined |

| Price Volatility | Very high | Low, more predictable |

| Consumer Protection | Weak, scams are common | Strong laws protect users |

| Inflation | Not a big issue | Can lose value if inflation rises |

| Technology Barriers | Hard to learn, complex | Easy to use, familiar |

Technology can also be a challenge. Many people think cryptocurrency is hard to use. Security worries and not knowing enough stop some people from trying it. You need to learn about wallets, private keys, and exchanges to use crypto. For fiat, you do not need special knowledge. You can use cash or cards easily.

Tip: Always learn about the risks before you choose cryptocurrency or fiat. Protect your money by staying informed.

Mining and Creation

Crypto Mining Machines

You can mine crypto with special machines called miners. These machines solve hard math problems. This helps add new transactions to the blockchain. Mining keeps the network safe. You also earn rewards for mining. Some machines use air-cooling. Others use hydro-cooling or liquid cooling. These help the machines work better.

Here are some popular crypto mining machines:

- Bitmain Antminer S21 Hyd (335Th) uses hydro-cooling to save energy.

- Bitmain Antminer S19 XP Hyd (255Th) uses liquid cooling for steady work.

- Antminer L11 20T uses air-cooling and consumes less electricity.

Tip: Cooling helps mining machines last longer and use less energy.

Best Crypto Miner for Beginners

Choosing the right mining machine is crucial if you’re a beginner eager to embark on your crypto mining journey. It depends on various factors like your budget, available space, electricity costs, and mining goals. Here are some top picks for home-based mining that are beginner-friendly.

1. Fluminer L1

Built specifically with new users in mind, it prioritizes low-power performance and quiet operation—two key features that ease common worries for first-timers, like high electricity bills or disruptive noise in living spaces. Its energy-efficient design keeps power consumption minimal, making it gentle on monthly utility costs, while its quiet operation ensures it won’t disturb daily life, whether placed in a home office, living room, or small apartment. This focus on accessibility and practicality makes the Fluminer L1 an approachable first step for anyone new to crypto mining, letting beginners learn the ropes without dealing with excessive energy use or loud equipment.

2. Fluminer L2

As a miner built for the Scrypt algorithm (ideal for coins like LTC and DOGE), it boosts mining output slightly compared to the L1, delivering a solid hash rate of around 1.8 GH/s. This extra performance doesn’t come with a big jump in power use, though: it keeps energy consumption low at approximately 420W, which stays efficient for home setups—no need to worry about skyrocketing electricity bills. For new users who want to scale their mining a little without sacrificing affordability or home-friendly energy use, the L2 hits the sweet spot between improved performance and practicality.

It delivers steady performance with a nominal hash rate of 2.1 GH/s, which fits most beginners’ daily mining needs; if you want to boost output later, it also offers an overclock mode that pushes the hash rate up to 2.4 GH/s, letting you adjust performance as you gain more mining experience. This flexibility in both coin support and hash rate makes it easy for new users to adapt to different mining scenarios without feeling limited by their equipment.

The Goldshell E-DG1M is a practical choice. As an ASIC miner engineered for Scrypt algorithm, it specializes in mining DOGE and LTC, with support for BEL too. It delivers a competitive max hash rate of 3.4 GH/s while using 1,800W of power, and it achieves excellent energy efficiency of 0.529 J/Mh. Its compact rectangular design fits easily on shelves or racks for space-saving use, and it keeps noise below 45dB—friendly for home environments. It also enhances blockchain privacy and scalability, making it suitable for both beginners and those wanting steady mining performance.

For beginners open to a slightly more flexible home mining setup, the Goldshell Byte with dual-card support is a solid pick. Launched in April 2025, this high-performance home miner runs on dual algorithms (zkSNARK and Scrypt) and optimizes for ALEO and DOGE tokens. It delivers a max 80 MH/s hashrate with only 65W power use, achieving 0.012 J/kH energy efficiency. It also has dual interchangeable algorithm cards for seamless strategy switches and a plug-and-play design for easy setup.

Miners for beginners often have:

- Easy interfaces for simple setup.

- Calculators to show possible earnings.

- Hardware and software that work together well.

Pick a miner that is easy to use and fits your space. Make sure it has good support and clear instructions. The right miner helps you avoid mistakes and saves money.

Fiat Money Creation

Central banks make fiat money in a different way. You do not need machines or computers for this. The process starts when the government sells bonds to get money. The central bank buys these bonds from banks or investors. When the central bank pays for the bonds, it adds new money to the seller’s account. This puts new money into the banking system.

Here are the main steps:

- Government sells bonds.

- Central bank buys bonds from banks or investors.

- The central bank adds new money to accounts.

Note: Central banks decide how much fiat money goes into the economy. This helps control inflation and keep prices steady.

Which is Right for You?

Choosing Based on Needs

You need to think about your goals before you pick a currency. Each type works better for different situations. If you want stability and easy use, fiat currency is a good choice. You can use it almost everywhere. You do not need special tools or knowledge. Banks and stores accept it. You can trust the value most of the time.

If you want fast payments and privacy, cryptocurrency may fit your needs. You can send money worldwide at any time. You do not need a bank. You can use a digital wallet. You control your money. You can also try crypto mining if you want to earn coins. You need a crypto mining machine for this. If you are new, look for the best crypto miner for beginners. These machines are easy to set up and use.

Here is a quick table to help you decide:

| Your Need | Best Choice | Why? |

|---|---|---|

| Everyday shopping | Fiat | Accepted everywhere |

| Fast global payment | Crypto | No borders, quick transfers |

| Privacy | Crypto | Less personal info needed |

| Stability | Fiat | Value stays steady |

| Earning from mining | Crypto | Use mining machines |

Tip: If you want to start mining, choose a beginner-friendly crypto miner. You can learn as you go.

Practical Scenarios

You face different situations every day. Here are some examples to help you choose:

- You want to buy groceries at a local store. You should use fiat currency. The cashier will accept cash or a card.

- You need to send money to a friend in another country. You can use cryptocurrency. The transfer is fast and costs less.

- You want to keep your spending private. You can use crypto for more privacy. Your name does not show on the blockchain.

- You want to earn extra money. You can buy a crypto mining machine. Start with the best crypto miner for beginners. You can mine coins at home.

- You want to save for the future. You can use fiat for steady savings. You can use crypto if you want to try new technology.

Remember: Your choice depends on your needs. Think about what matters most to you. Try both if you want to learn more.

You have learned the main ways cryptocurrency and fiat currency are not the same. Crypto lets you send money fast. It gives you more privacy and control over your money. Fiat is steady, and most places accept it. If you want to mine crypto, you need a mining machine. Pick a beginner crypto miner to help you start. Pick the type of money that works best for you.

Money is changing in new ways. Keep asking questions and learn about all your choices.

FAQ

What is the main difference between cryptocurrency and fiat currency?

Fiat currency is used every day by most people. Governments are in charge of fiat. Cryptocurrency is digital and not run by one group. You can send crypto to anyone, anytime, anywhere. Fiat is more steady and almost all places take it.

Can you use cryptocurrency for everyday purchases?

Some stores and websites let you pay with cryptocurrency. Big companies are starting to accept crypto payments. Most small shops still want cash or cards. More people use crypto each year.

Is mining cryptocurrency hard for beginners?

You can mine crypto if you have the right tools. There are easy-to-use crypto mining machines for beginners. These machines come with simple guides. Learn the basics before you start mining. Begin with small steps and build your skills.

Is cryptocurrency safer than fiat money?

You are in charge of your own crypto wallet. Hackers try to steal from digital wallets and exchanges. Banks use strong security to protect fiat money. Both types have risks. Always use strong passwords and watch out for scams.

Why does the cryptocurrency price change so much?

Crypto prices go up and down because of supply and demand. News and 24/7 trading also make prices move fast. You can win or lose money quickly with crypto.

Bitmain

Bitmain Iceriver

Iceriver

Bitdeer

Bitdeer BOMBAX

BOMBAX DragonBall

DragonBall Elphapex

Elphapex Fluminer

Fluminer Goldshell

Goldshell iBelink

iBelink Ipollo

Ipollo Jasminer

Jasminer Volcminer

Volcminer

Aleo Miner

Aleo Miner