Blog

Table of Contents

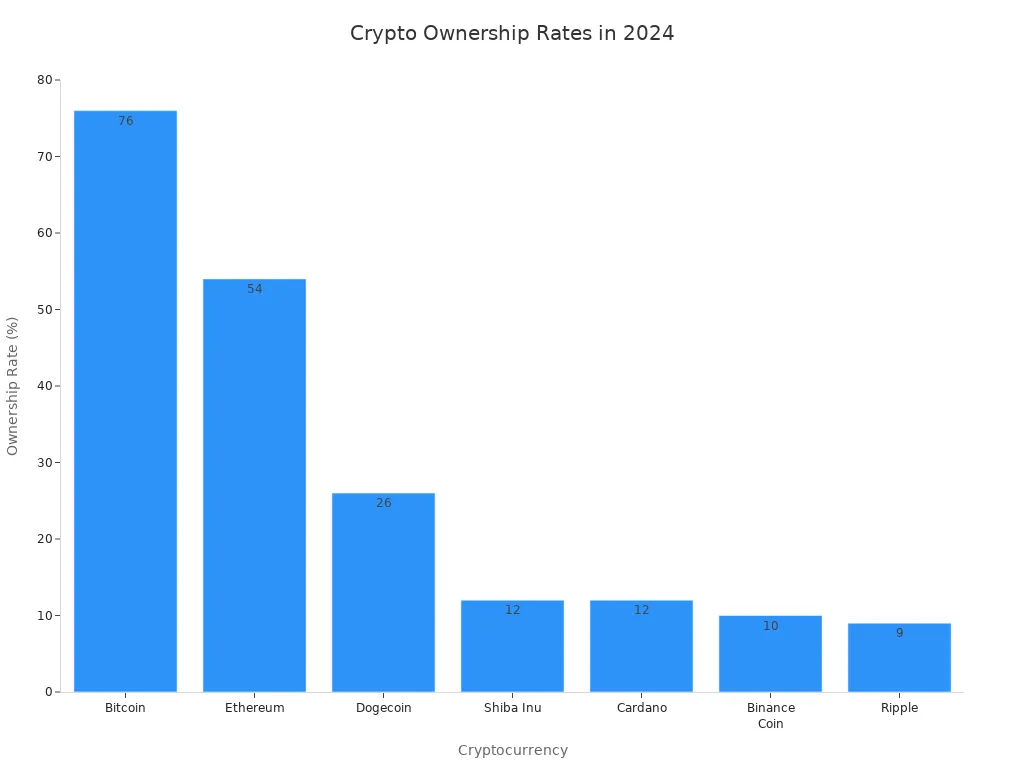

For 2025, the question of Bitcoin VS Altcoin which is better to invest? remains crucial. The answer depends on your risk tolerance. Bitcoin is generally the safer choice, making up over half of the cryptocurrency market, with about 76% of crypto owners holding bitcoin. On the other hand, altcoins can offer bigger rewards but come with higher risk and more price volatility. Recent studies show that only a few top altcoins performed well, while most altcoins lost value quickly. Big companies have supported bitcoin’s growth, whereas altcoins are gaining popularity in emerging markets, often used for real-world applications and DeFi. If you prefer less risk, bitcoin might be the better investment. But if you’re aiming for bigger gains, you must accept the higher risk that comes with altcoins.

Taking a closer look at Bitcoin VS Altcoin which is better to invest? involves analyzing trends, risks, and potential returns. The choice between bitcoin and altcoins depends on your personal goals and current market conditions.

Key Takeaways

Bitcoin is more stable and has less risk. This makes it safer for people who want to invest for a long time. Altcoins can give bigger rewards. But their prices change a lot and they are more risky. If you buy both bitcoin and altcoins, you can balance your risk. This can also help you get better returns. New rules and more support from big companies make bitcoin more trusted. More people are starting to use it. Use tools and make clear plans. This helps you pick investments that fit your risk level and goals.

Bitcoin vs Altcoins: Risk and Return

Volatility and Market Cap

Volatility is very important when talking about bitcoin and altcoins. In 2023, bitcoin’s price did not change as much as before. Its volatility went below 50%. This was not common for the crypto market. The trend kept going in early 2024. Bitcoin’s price went over $60,000. Even then, its price did not jump up and down a lot. This shows bitcoin is getting more stable. It now moves less than some big company stocks. For example, bitcoin’s 90-day volatility was 46%. Netflix’s was higher at 53%. By late 2023, bitcoin was less volatile than 33 S&P 500 companies. This means bitcoin is becoming a steadier investment.

The difference between bitcoin and altcoins is clear when looking at market cap. In 2024, bitcoin’s market cap is about $2.43 trillion. This is almost 64% of all crypto value, which is $3.8 trillion. All altcoins together have about $1.37 trillion. Bitcoin’s big size gives it a special place in crypto. Many investors think bitcoin is safer because it is bigger and more stable. Altcoins are liked by many people. But they do not have bitcoin’s big market cap or growing trust.

Note: Lower volatility and a bigger market cap usually mean less risk. Bitcoin’s steady price attracts people who want fewer surprises.

Bitcoin vs Altcoins Returns

Returns are very important when picking investments. Comparing bitcoin and altcoins shows some big trends. Bitcoin has given strong returns for 15 years. Its yearly return is 67%. This high return comes with similar ups and downs. If you add bitcoin to a normal 60/40 portfolio, the Sharpe ratio goes up from 0.85 to 1.51. This means you get better returns for the risk you take. The yearly return also jumps from 10.6% to 21.9%. This happens without much more risk or bigger losses.

Metric | Value | Notes |

|---|---|---|

Bitcoin Sharpe Ratio (since 2010) | ~1.35 | Higher than any other established asset class |

Sharpe Ratio of traditional 60/40 | 0.85 | Baseline portfolio without bitcoin |

Sharpe Ratio of 60/40 + 5% bitcoin | 1.51 | Significant improvement with small bitcoin |

Bitcoin Annualized Return (15 years) | 67.0% | High return, high volatility |

Portfolio Return (60/40 + bitcoin) | 21.9% | Compared to 10.6% without bitcoin |

Volatility and Max Drawdown | No meaningful increase | Despite higher returns and Sharpe ratio |

The story for altcoins is not as clear. Most altcoins do not have long-term data like bitcoin. Some altcoins have made big gains in a short time. But many lose value fast. This makes them riskier for investors. Altcoins often go up and down with trends. Investors need to watch for quick changes in price and returns.

Bitcoin gives high returns with less price change than many assets.

Altcoins can give bigger short-term gains but are riskier.

The main difference is in their stability, size, and risk.

Tip: Investors should use risk tools before picking bitcoin or altcoins. Knowing the risk and reward helps you make better choices.

Key Factors for 2025

Market Trends

In 2025, the cryptocurrency market is changing in big ways. Tokenization lets people own small parts of real-world things, like houses. This makes it easier to buy and sell these assets. Blockchain platforms help support these new assets. Now, more people can join the crypto market. Artificial intelligence is also making a difference. AI tokens are now worth over $39 billion. More people use computers to trade automatically. Venture capitalists still put money into blockchain startups. They invested $485 million in these companies. Investors want products that can handle risk and price swings. Bitcoin is growing because governments support it. For example, the Strategic Bitcoin Reserve helps make bitcoin look more trustworthy. These trends show that the crypto market is getting older and more open.

Regulation

Rules are very important for the crypto market. In the United States, the SEC said yes to some Bitcoin ETFs. This made more big companies want to buy bitcoin. The CFTC calls bitcoin a commodity, which helps with rules. The EU’s MiCA rule starts in April 2025. It gives clear steps for following the law. Japan and Singapore have simple rules that help new ideas grow. China has very strict rules against crypto. The GENIUS Act and other laws want stablecoins to have enough money saved and regular checks. These rules help lower risk and make prices less jumpy. But altcoins still have unclear rules. This makes them riskier. Bitcoin gets help from new rules, but altcoins must deal with changes.

Region | Regulatory Changes and Impact on Bitcoin and Altcoins |

|---|---|

United States | The SEC said yes to Bitcoin ETFs, so more big companies buy bitcoin. The CFTC calls bitcoin a commodity, which helps with rules. AML/KYC rules affect how big companies use crypto. States have different rules. The SEC is careful with altcoins, so fewer big companies buy them. |

Europe | The EU’s MiCA rule gives clear rules and steps to follow. Some countries have their own rules. Clear rules help people invest in bitcoin, but it costs more to follow the rules. |

Asia-Pacific | China has very strict rules against crypto. Japan has clear rules that help bitcoin. Singapore helps new ideas grow. Altcoins have unclear rules, so they do not grow as fast. |

General Impact | Clear rules help more big companies buy bitcoin. This makes more people want it. Altcoins do not have clear rules, so their prices do not go up as much. Following the rules costs money, but it helps keep the market safe. CBDCs might work with or against bitcoin. |

Technology

Technology is helping crypto grow fast. Now, big companies keep bitcoin as part of their savings. Spot crypto ETFs make it easy for big groups to buy bitcoin and Ethereum. Some ETFs let people earn rewards by staking. New rules, like the crypto market structure bill, could help altcoins and DeFi grow. Ethereum has new ways to stake, which may bring in more big investors. Some blockchain companies, like Circle, are now on the stock market. These changes help make prices less wild and lower risk. They also help the crypto market get ready for the future.

Institutional Adoption

Big companies are changing the crypto market. In the U.S., spot Bitcoin ETFs got approved. By the middle of 2025, these ETFs held over 100,000 BTC. Public companies now have about $93.3 billion in bitcoin. MicroStrategy owns the most. Some companies are starting to buy altcoins too. This shows altcoins could grow more soon. Big banks now help people keep and trade crypto. Old finance companies are using blockchain technology. Large holders, called whales, keep buying bitcoin. This helps keep prices steady and less jumpy. All of this means big companies help the crypto market grow and stay strong.

Diversification: Bitcoin and Altcoins

Portfolio Strategies

Diversification is very important in crypto. If you own both bitcoin and altcoins, you can lower risk. You might also get better returns. As crypto gets older, diversification matters more. After the pandemic, bitcoin does not lower risk as much in normal portfolios. Now, investors need new ways to balance risk and reward in crypto.

There are different portfolio strategies for different goals. The table below shows some common ways to spread out your crypto investments:

Portfolio Type | Allocation Breakdown | Goal | Ideal For |

|---|---|---|---|

Conservative Portfolio | 60-70% bitcoin/ETH, 30-40% large-cap altcoins | Capital preservation with modest growth | Risk-averse investors, long-term holders |

Balanced Portfolio | 40% bitcoin/ETH, 40% mid-cap altcoins, 20% small-cap tokens | Mix of stability and growth potential | Investors seeking balance between risk and return |

Aggressive Portfolio | 20% bitcoin/ETH, 30% mid-cap altcoins, 50% small-cap tokens | Maximize returns during altcoin cycles | High-risk appetite investors |

Tip: If you spread your crypto across different types and sizes, you can lower risk and maybe get better returns.

Risk Management

Risk management is very important in crypto. Prices change a lot, so you need to be careful. Diversification means you do not put all your money in one place. If you own both bitcoin and altcoins, you can avoid big losses if prices drop fast. This helps when the market changes quickly. You should check your investments often. Change your plan if the market or your risk level changes.

Optimizing Returns

To get the best returns in crypto, you need to use different plans. You can HODL, buy a little at a time, or trade when prices swing. Staking and yield farming let you earn extra money without selling. Diversification is still one of the best ways to balance risk and reward. You should also use charts and tools to help you decide. If you know when to take profits and watch the market, you can do better. Being active and spreading your money out is very important in crypto because things change fast.

Expert Views and History

Analyst Predictions

Experts think the cryptocurrency market will grow a lot in 2025. Many believe bitcoin will reach new record prices. Michaël van de Poppe thinks bitcoin could hit $125,000 by July 2025. He also says it might reach $250,000 by the end of the year. BitBull expects bitcoin to go up to $120,000 soon. They think it could even reach $140,000 for a short time. Charles Hoskinson also believes bitcoin can get to $250,000. He says new rules and more trust will help the market.

Expert/Analyst | Price Target Timeline | Supporting Evidence/Indicators |

|---|---|---|

Michaël van de Poppe | $125,000 by July 2025 | Break above $110K-$112K resistance, liquidity sweep below $105K |

$150,000 by end of Q3 2025 | Accumulation around $100.4K-$105K, rising volume | |

$250,000 by Q4 2025 | Potential parabolic run if prior targets surpassed | |

BitBull | $120,000 soon | Break above $117,000, consolidation expected |

$135,000 - $140,000 local top | Pattern similar to Feb 2024 rally pause, altcoin catch-up phase | |

Charles Hoskinson | $250,000 by 2025 | Regulatory developments legitimizing market |

Some altcoins look good too. Stellar Lumens (XLM) might go up 50% and reach $0.50. XRP could rise to $5 if new ETFs and big investors join in. The ProShares XRP ETF is coming in July 2025. This could make people trust the crypto market more.

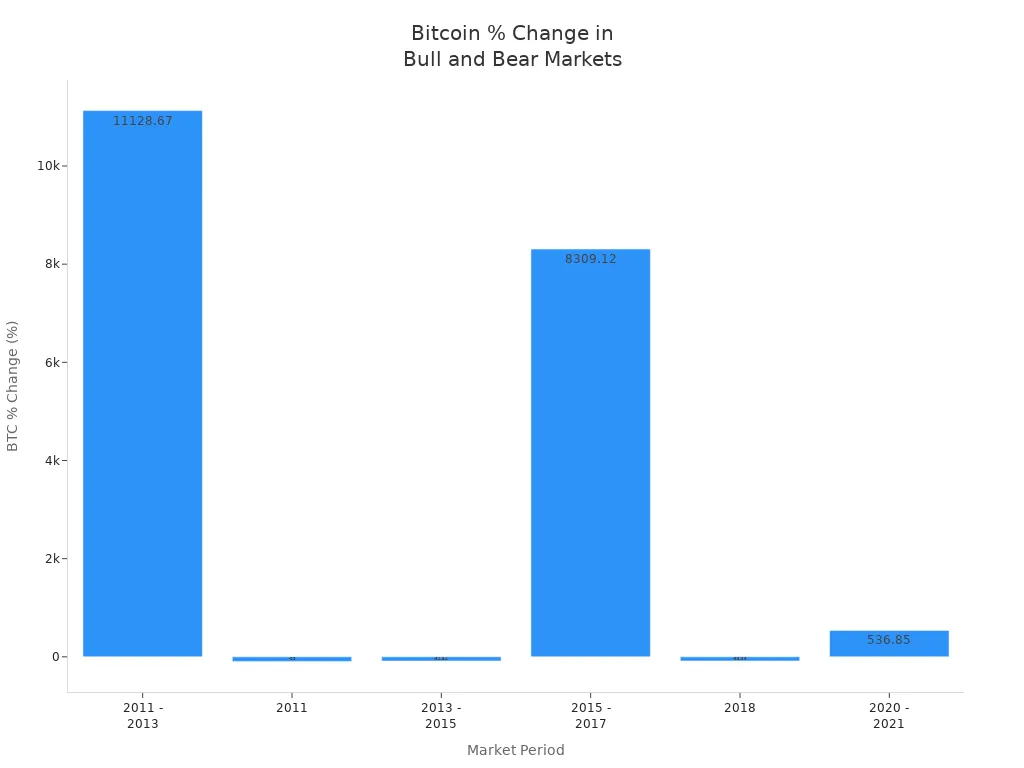

Past Performance

Bitcoin has always led big price jumps in the crypto market. In 2017, bitcoin went from $200 to almost $20,000. Altcoins usually go up after bitcoin does well. In 2020 and 2021, both bitcoin and altcoins hit their highest prices ever. This happened because of new technology and more people investing. In bear markets, like in 2018, prices dropped a lot for both bitcoin and altcoins. Bitcoin usually does not fall as much as altcoins during these times.

Market Period | Market Type | Bitcoin Price Range (AUD) | BTC % Change | Altcoin Performance & Notes | Key Catalysts & Events |

|---|---|---|---|---|---|

2011 - 2013 | Bull Market | $2.93 to $329 | +11,128.67% | Bitcoin surged; altcoins gained traction. | European recession, Cyprus crisis, distrust in banks. |

2018 | Bear Market | $27,883.86 to $4,633.70 | -83.38% | Altcoins crashed with bitcoin. | ICO bubble burst, regulatory crackdowns, scams. |

2020 - 2021 | Bull Market | $14,346 to $91,363 | +536.85% | Bitcoin and altcoins hit new highs. | COVID-19, institutional investment, NFT boom, DeFi summer. |

Bitcoin VS ltcoin Which is Better to Invest?

Looking at the crypto market, bitcoin is more stable and less risky. Big companies like to invest in bitcoin, and new rules help it too. Bitcoin has a long record of good returns and smaller price changes. Altcoins can make more money but are riskier and prices change a lot. Many traders see altcoins as a gamble. The choice between bitcoin and altcoins is important for every investor. People who do not like risk often pick bitcoin. If you want bigger gains and can handle risk, you might choose altcoins. Past data shows bitcoin leads the market, and altcoins follow or sometimes do better in strong bull runs. It is important to study the market and manage risk before investing in crypto.

Actionable Advice for Investors

Risk Tolerance

Investors need to know how much risk they can handle before buying cryptocurrency. Having a clear plan helps you avoid mistakes and make smart choices.

Think about how long you want to keep your investment. If you plan to invest for many years, you can take more risk. If you need your money soon, you should be careful.

Check your money situation, like your job, debts, and savings.

Decide what you want from your investment. If you want to grow your money over many years, you can take more risk. If you want quick gains, you should take less risk.

Think about how much you know about cryptocurrency.

Notice how you feel when prices go up and down.

Remember your age. Younger people often take more risk.

Make sure you have money you can use quickly if needed.

Think about how your family or culture affects your choices.

Investors should use tools like spreading out their money, picking the right amount for each investment, and setting stop-losses to help avoid big losses.

Time Horizon

How long you want to invest changes what you should buy in crypto.

People who want to invest for a long time often pick bitcoin. Bitcoin is rare and has been around for a while.

Bitcoin is good for fighting inflation and gives steady returns over time.

Altcoins are for people who want to try for bigger gains fast, but they are riskier.

Mixing bitcoin and other coins depends on how much risk you want and your goals.

Checking your investments often and making changes helps you stay on track as your goals change.

Tools and Resources

Investors can use different websites and tools to compare bitcoin and other cryptocurrencies:

Tool/Platform | Description | Key Features/Use Case |

|---|---|---|

Token Metrics | Uses AI to rate coins and track returns in real time. | Gives data to help pick bitcoin or altcoins. |

IntoTheBlock | Shows signals and price guesses using blockchain data. | Helps find out how people feel about the market and spot trends. |

Cointree | Lets you track your coins and see market data. | Helps you compare how your coins are doing and see the big picture. |

Chainalysis | Gives info about how bitcoin moves and what is trending. | Shows what is happening in the world market. |

Token Terminal | Shows money numbers from blockchains and dApps. | Lets you check coins using normal finance ideas. |

Coindar | Has a calendar for big crypto events. | Lets you watch for events that could change prices. |

The Coin Perspective | Lets you compare coins by size and guess future prices. | Helps you see how bitcoin and altcoins might do in the future. |

These tools help you study the market and make better choices when buying crypto.

Yesmining for Bitcoin and Aleo

Yesmining helps people mine both bitcoin and Aleo in the crypto world.

Mining bitcoin gives steady returns but uses lots of energy and does not hide your info.

Mining Aleo uses less energy and keeps things private with special tech.

Aleo’s system and strong support make it good for people who want lower costs and privacy.

Mining groups like f2pool and DxPool give steady rewards and better safety.

Investors should watch for new rules and keep their machines working well to get the best results.

If you want to mine, Yesmining has special sites for Bitcoin mining and Aleo mining to help both new and skilled miners.

Bitcoin is usually the safer pick for most people. It gives steady prices and can go up more as big companies buy it. Altcoins might make you more money, but you need to study them and be careful with risk.

People should choose their crypto plan based on how much risk they can take and what they want to achieve.

The table below shows which type of investor should pick Bitcoin or altcoins:

Investor Type | Best Fit |

|---|---|

Wants steady prices | Bitcoin |

Wants bigger gains and can handle risk | Altcoins |

Yesmining lets you mine both Bitcoin and Aleo if you want more ways to earn. Keep learning, spread out your investments, and check your plan often as 2025 gets closer so you can handle the differences between bitcoin and altcoins.

FAQ

What is the main difference between bitcoin and altcoins?

Bitcoin was the first cryptocurrency and is still the biggest. Altcoins are all the other coins that are not bitcoin. Bitcoin is known for being more stable. Altcoins can make you more money, but they are riskier. The main differences are in how they work, what they are used for, and how risky they are.

How should investors decide between bitcoin and altcoins in 2025?

Investors need to think about how much risk they can handle. They should also know what they want from their investment. Bitcoin is good for people who want steady prices. Altcoins are better for those who want to try for bigger rewards. Asking yourself which is better, bitcoin or altcoins, can help you choose.

Can holding both bitcoin and altcoins improve a portfolio?

Yes, owning both can help lower risk and maybe get better returns. Many experts say it is smart to have some of each. This way, you can be safer and still try to grow your money.

Are altcoins riskier than bitcoin?

Altcoins change price more often than bitcoin. They do not have as much trust or value as bitcoin. You might win or lose more money with altcoins.

What tools help compare bitcoin and altcoins?

People use websites like Token Metrics, IntoTheBlock, and Cointree. These sites show prices, trends, and how coins are doing. They help you decide if bitcoin or altcoins are better for you.

Is Mining the best choice for 2025?

Yes, we have been advising our customers to mine bitcoin or Aleo.

Because you will never buy spot at the lowest point, nor sell it at the highest point, so you may need a habit like fixed investment like Miner to continuously produce coins for you.

Bitmain

Bitmain Iceriver

Iceriver

Bitdeer

Bitdeer BOMBAX

BOMBAX DragonBall

DragonBall Elphapex

Elphapex Fluminer

Fluminer Goldshell

Goldshell iBelink

iBelink Ipollo

Ipollo Jasminer

Jasminer Volcminer

Volcminer

Aleo Miner

Aleo Miner