Blog

Table of Contents

Electricity costs play a crucial role in Bitcoin mining profitability. In 2024, the Bitcoin halving reduced block rewards, forcing miners to work harder to maintain efficiency. With network difficulty increasing and transaction fees decreasing, it has become more challenging for miners to generate profits.

Electricity costs now account for about 40–60% of total mining expenses.

Bitcoin mining profitability faces more competition due to the highest network difficulty ever recorded.

Many miners are adopting energy-efficient machines or relocating to areas with cheaper electricity to improve profitability.

Ultimately, Bitcoin mining profitability depends on carefully managing costs and making strategic decisions. Choosing the right hardware and location will be key factors shaping the future of Bitcoin mining.

Key Takeaways

Electricity costs are the biggest part of Bitcoin mining expenses. They are often 40–60% of the total cost. Finding cheap power is very important for making money.

Using energy-efficient mining machines uses less electricity. This helps miners save money and get a better return on investment (ROI).

Miners often move to places with lower electricity prices. This helps them spend less and make more profit from mining.

Bitcoin halving and higher network difficulty make mining harder. Miners must watch their costs and pick good hardware and locations to keep making money.

Joining mining pools, using monitoring tools, and planning for risks like price changes and rules help miners keep steady profits over time.

Electricity Costs in Bitcoin Mining

Cost Structure

Bitcoin mining uses a lot of energy to run strong machines. The main costs are for hardware and electricity. Hardware means the computers and ASIC miners that do the mining. Electricity is needed to keep these machines running all day. Over time, electricity makes up about 60% of the total mining cost. This makes electricity the biggest cost that keeps coming back. Hardware is bought once, but electricity is always needed. The price of electricity can change how much money a miner earns. If energy costs are high, it is harder to make a profit from bitcoin mining.

Ongoing Expenses

Electricity costs are different depending on where miners work and what power deals they get.

Some miners pay less by making special deals for power.

Electricity prices are not the same in every country or city.

Big mining farms often move to places with cheaper power or get better machines to save money.

Sometimes miners use renewable energy, like hydropower, when it is rainy.

Local laws and rules can also change how much miners pay for power.

The kind of miner and how well it works are important too. Better machines use less power to do the same job, so they need less electricity to mine bitcoin.

Halving Impact

The 2024 bitcoin halving made block rewards half as big. Now, miners must work harder to get the same amount of bitcoin. Network difficulty is higher, so miners need more energy and better machines to make money.

Mining difficulty will probably keep going up in 2025.

Miners with cheap or green energy will do better.

New ASIC machines help lower energy costs, but the total need for electricity is still growing.

Miners who cannot control their electricity costs may have to stop mining. Miners who use good machines and find cheap power will have the best chance to make money.

Bitcoin Mining Profitability Factors

ROI Meaning

ROI means “Return on Investment.” It shows how much profit a miner makes. Miners use ROI to check if they are making money. A high ROI means they earn more than they spend. A low ROI means costs are too high or profits are too low. ROI helps miners know if they should keep mining or change something.

ROI Formula

The usual way to find bitcoin mining ROI is:

ROI = ((Total Revenue - Total Cost) / Total Cost) × 100%

For example, if a miner spends $1,120 and earns $6,000 in one year, the ROI is:

This formula lets miners see how much money they make and compare choices.

Key Influences

Many things change bitcoin mining ROI. The most important are:

Equipment costs: New machines cost more but work faster.

Electricity rates: Electricity is a big cost. Lower rates help miners earn more.

Network difficulty: More miners make mining harder and can lower profits.

Bitcoin price: If bitcoin goes up, mining is better. If it drops, profits go down.

Hardware efficiency: Good machines use less power and help ROI.

Bitcoin halving: Halving cuts rewards, so miners must watch costs.

Miners with cheap power and good machines usually get better ROI.

Other Hidden Cost

Some costs are not easy to see but still matter:

Cooling equipment: Machines get hot and need cooling, which uses more power and money.

Maintenance: Cleaning and fixing machines keeps them working. Repairs can stop mining and lower profits.

Taxes and regulations: Some places tax bitcoin or need special permits.

Hardware depreciation: Machines lose value and may need to be replaced.

Noise control: Some miners pay more to make their machines quieter.

Tip: Miners should count all costs, not just power and machines, to know if they are making money.

Cost to Mine 1 Bitcoin

Electricity Rates

Electricity rates are very important for mining 1 bitcoin. Miners pay for every bit of electricity their machines use. The price of electricity is different in each country. Some places have cheap power, but others are expensive. If electricity is cheap, miners spend less to mine 1 bitcoin. Expensive electricity makes mining cost more and lowers profits.

It takes about 202,809.39 kilowatt-hours (kWh) of electricity to mine one bitcoin. Even a small change in electricity price can change the total cost a lot.

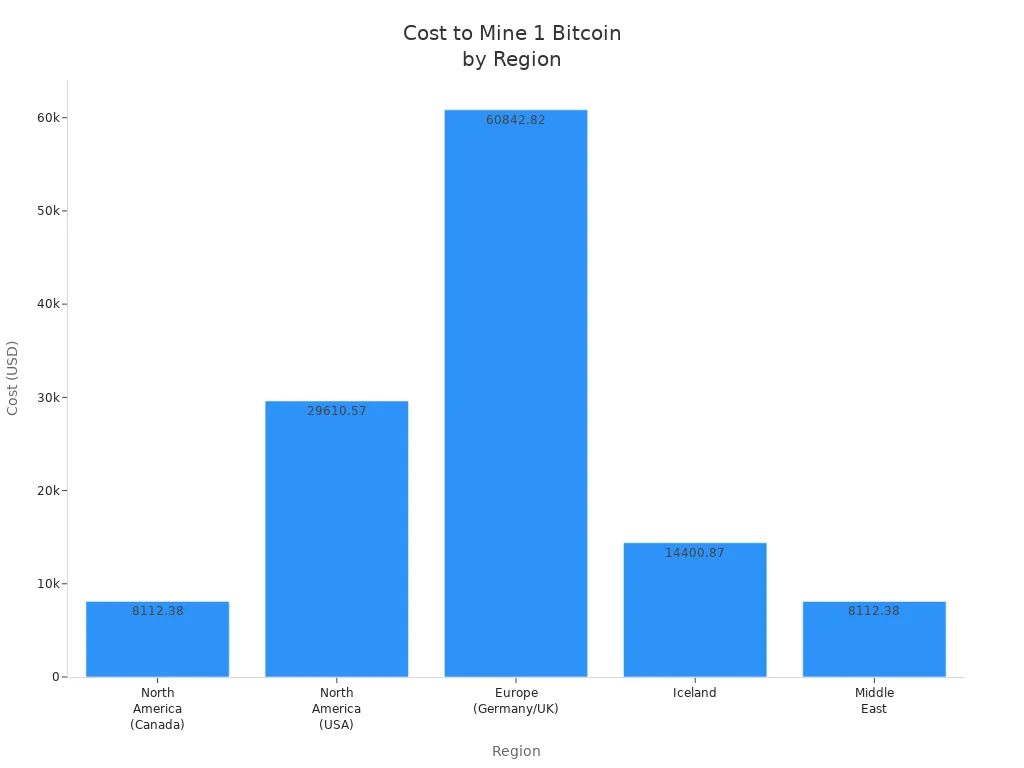

Here is a table that shows electricity costs in different places and how they change mining costs:

Region | Electricity Cost (per kWh) | Impact on Bitcoin Mining Cost |

|---|---|---|

North America | $0.04 (parts of Canada) to $0.146 (USA) | Cheaper power in Canada brings in mining companies. Higher prices in the US make mining cost more. |

Europe | > $0.3 (Germany, UK, others) | High power prices make mining cost more and less competitive. |

Iceland | ~$0.071 | Cheap power from renewable energy lowers mining costs. |

Middle East | < $0.04 (Qatar, Lebanon, Syria) | Cheap electricity makes mining cost less and helps profits. |

Miners in Canada and the Middle East pay less for power, so mining 1 bitcoin costs less. In Europe, high power prices make mining much more expensive.

Global Differences

The cost to mine 1 bitcoin is not the same everywhere. Some countries have special energy or help from the government to lower costs. Here are some examples:

Paraguay has lots of hydroelectric power. This gives miners very cheap electricity, but rules can change fast.

Argentina uses extra natural gas for cheap energy. This helps miners, even though the country has money problems.

The United Arab Emirates has many energy sources and government help. Miners pay less for power, but cooling costs more because it is hot.

Ethiopia uses hydroelectric power to keep costs low. Mining is growing fast, but there are political risks.

Kazakhstan uses coal for energy. Power was cheap, but new rules made mining harder and more costly.

Let’s look at three big mining countries in 2024 to see how much electricity prices matter:

Country | Notes | |

|---|---|---|

United States | $0.03 - $0.06 per kWh (mining clusters in TX, KY, GA, NY) | Industrial average is about $0.0815/kWh. Miners try to avoid market risks. The US has about 38% of the world’s mining power. |

China | Below $0.05 per kWh (underground mining in Sichuan, Xinjiang) | Mining is banned since 2021, but some miners still work underground. China has about 20% of the world’s mining power. |

Kazakhstan | $0.03 - $0.06 per kWh | Power is about three times cheaper than in the US. In March 2022, it cost about $8,762 to mine one bitcoin. Many miners invest here. |

In March 2022, mining 1 bitcoin in Kazakhstan cost about $8,762. This is because electricity is cheap, so many miners go there. In the US, electricity prices change by state, but some places have low prices that help miners. In China, even after the ban, some miners still find cheap power in certain areas.

The chart below shows how mining costs are different in each region:

Note: Miners often move to countries with cheaper electricity to save money and make more profit.

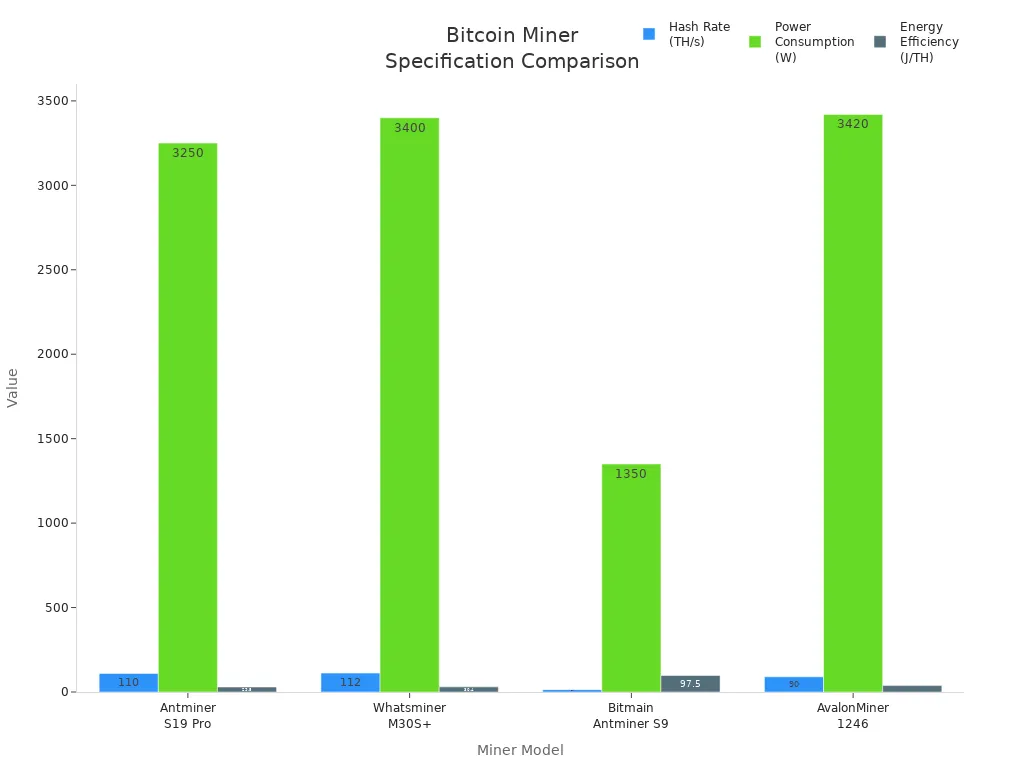

Machine Efficiency

Machine efficiency is also very important for mining 1 bitcoin. Efficiency is measured in joules per terahash (J/TH). This number shows how much energy a machine uses to do mining work. A lower J/TH means the machine uses less power for the same job.

For example, a mining machine with 29.5 J/TH and a hash rate of 110 TH/s uses about 3,245 watts. If electricity costs $0.10 per kWh, the daily power cost is about $7.79. Machines that are more efficient use less power, so miners pay less to mine 1 bitcoin.

Tip: Miners who use efficient machines can save a lot of money on electricity, especially where power is expensive.

The J/TH ratio is very important. Miners with lower J/TH can mine 1 bitcoin using less energy. This lowers the total cost and helps miners make more money, even if electricity prices go up. Machines with higher J/TH use more power and make mining cost more. Picking efficient machines is one of the best ways to lower mining costs and earn more profit.

Location and Electricity

Profitable Regions

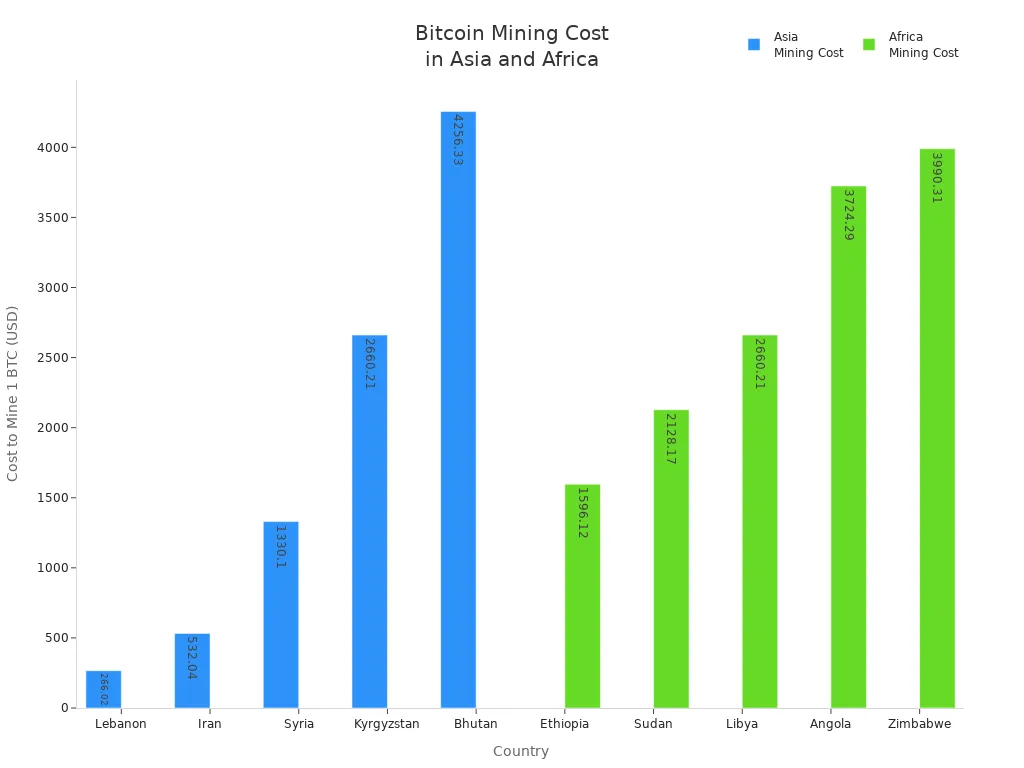

Electricity prices decide where bitcoin mining makes the most money. Some countries in Asia and Africa have very cheap electricity. This makes them good places for miners. In these places, mining 1 bitcoin costs much less than in Europe or North America. For example, Lebanon and Iran let miners spend under $600 to mine 1 bitcoin. This is because their electricity costs less than 5 cents per kWh. Ethiopia and Sudan in Africa also give miners a chance to mine for less money.

Region | Notable Countries | Average Cost to Mine 1 BTC (USD) | Approximate Electricity Cost per kWh |

|---|---|---|---|

Asia | Lebanon, Iran, Syria | Lebanon: $266.02, Iran: $532.04 | Below $0.05 |

Africa | Ethiopia, Sudan, Libya | Ethiopia: $1,596.12, Sudan: $2,128.17 | Below $0.05 |

Europe | Germany, UK | $85,767.84 (average) | Above $0.10 |

Miners like places where electricity is under 5 cents per kWh. If it costs more than 10 cents per kWh, miners often lose money.

Many miners move to countries with cheap power to save money. Asia has 34 countries where solo mining can make a profit. Africa has 18 countries where this is possible. These places often use hydro or green energy. This helps keep electricity prices low and steady.

Legal Risks

Bitcoin miners face many legal problems, even in places with cheap power. Governments can change rules fast, which makes mining risky. Some countries, like China, do not allow bitcoin mining at all. Others, like Iran, let people mine but may stop them if there is not enough power.

Rules can be unclear and may change suddenly.

Each country has different rules for licenses and following the law.

Some places have rules to protect the environment. These may make miners use green energy or less power.

Taxes can change and affect how much money miners keep.

Some countries, like Kazakhstan and Ethiopia, made new laws that change how easy it is to mine.

For example, Kazakhstan had cheap power, so many miners moved there. Too many miners used up a lot of power. The government then made new rules to protect the power supply. In the United States, some states help miners with tax breaks. Other states make mining harder because they worry about the environment.

Miners need to watch for new laws and plan for problems. Cheap power does not always mean miners will make money for a long time.

Energy-Efficient Bitcoin Mining Machines

Efficiency Metrics

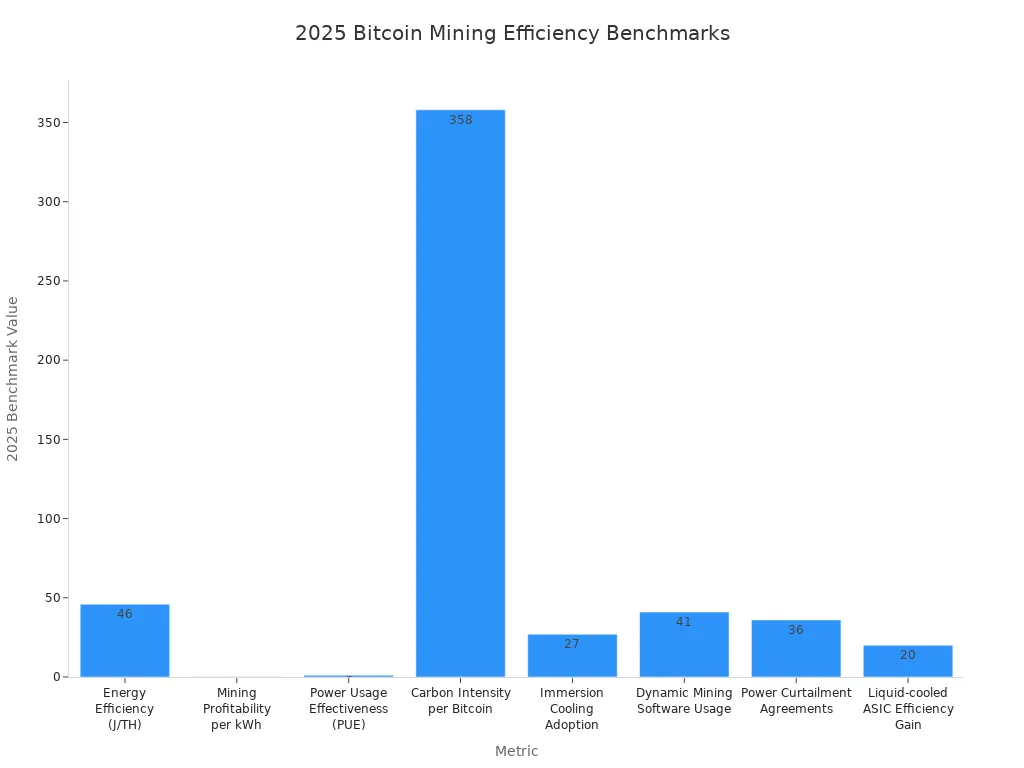

Bitcoin mining machines need a lot of power to work. People check how good they are by looking at joules per terahash (J/TH). This number tells how much energy a machine uses for one trillion calculations. If the J/TH is lower, the machine saves more power and money. In 2025, the best machines use 46 J/TH. That is 12% better than last year. Other numbers matter too, like how much money miners make for each kWh, how well power is used (PUE), and how much carbon is made for each bitcoin. These numbers help miners pick the best machines for more profit.

Metric | 2025 Benchmark Value | Notes/Comparison to 2024 |

|---|---|---|

Energy Efficiency (J/TH) | 46 J/TH | 12% better than 2024 |

Mining Profitability per kWh | $0.093 | Slight increase |

Power Usage Effectiveness (PUE) | 1.18 | Improved from 1.23 |

Carbon Intensity per Bitcoin | 358 kg CO₂e | Lower than 2024 |

8 Top Bitcoin Miners in 2025

The best mining machines in 2025 save lots of power. They also give high hash rates and better profits. Here is a table that shows the top eight mining machines:

| Manufacturer | Model | Hash Rate | Power Consumption (W) | Efficiency (J/TH) | Cooling Method | Release Date | Price (USD) |

|---|---|---|---|---|---|---|---|

| Bitmain | Antminer S21 XP Hyd | 473 TH/s | 5676 | 12 | Hydro | Q4 2025 | $9,460 |

| Bitmain | Antminer S21 XP+ Hyd | 500 TH/s | 5500 | 11 | Hydro | July 2025 | $12,000 |

| Bitmain | Antminer S21e XP Hyd | 860 TH/s | 11180 | 13 | Hydro | Jan 2025 | $24,000+ |

| Bitmain | Antminer L11 | 20 GH/s | 3680 | 18.4 | Air | 2025 | $8,599 |

| Bitmain | Antminer L11 Pro | 21 GH/s | 3612 | 17.2 | Air | 2025 | $10,295 |

| Bitmain | Antminer L11 HYD 6U | 33 GH/s | 5676 | 17.2 | Air | 2025 | $16,999 |

| Bitmain | Antminer S23 Hyd 3U | 1.16 PH/s | 11020 | 9.5 | Hydro | 2025 | $28,500 |

| MicroBT | Whatsminer M63S++ | 478 TH/s | 10000 | 15.5 | Hydro | 2025 | $10,400 |

These machines use new technology and better cooling. Hydro-cooled models, like the Antminer S21 XP+ Hyd, are the most efficient and save the most money.

Hardware and ROI

Picking energy-efficient ASIC miners helps miners pay less for power. It also helps them earn more profit. New machines, like the Antminer S21 XP+ Hyd, use much less power than old ones. For example, the Antminer S19k Pro uses 24 W/TH. Older machines use over 30 W/TH. This means miners spend less on electricity and keep more money.

Since 2018, energy use per terahash has gone down by 63%. This helps miners save money and makes less pollution. Efficient machines also make less heat, so cooling costs less. All these savings help miners make more money over time. In the future, miners who choose efficient hardware will get better profits and help the planet.

Tip: Miners who buy energy-efficient machines can save more money, use their machines longer, and get better profits from bitcoin mining.

Maximizing Bitcoin Mining Profitability

Miner Selection

Picking the best mining machines helps miners earn more money. Miners should choose hardware that uses less power and works well. Here are some easy ways to do this:

Choose energy-saving machines like ASICs or FPGAs. These use less electricity for each hash.

Use GPUs instead of CPUs. GPUs usually work better for mining.

Pick power supply units with 80 Plus certification. This helps stop wasting electricity.

Check power use with meters and software. This helps find parts that use too much energy.

Upgrade to machines with better watt-per-hash ratios. Even if they cost more at first, they save money later.

Keep machines and software updated. This helps them work their best.

Tip: Miners who keep machines efficient and fix them often can make more money and save more over time.

Reducing Electricity Costs

Electricity is the biggest cost for bitcoin miners. Miners can spend less and earn more by doing these things:

Move mining to places with cheap electricity, like Iceland or Canada.

Use renewable energy like solar, wind, or hydro power. This saves money and helps the planet.

Put in better cooling systems, like immersion cooling. This lowers the power needed for cooling.

Join programs that let miners work during off-peak hours. This can get them cheaper electricity rates.

Use batteries to store extra renewable energy for later.

These ideas help miners spend less and make mining more steady and profitable.

Tools and Pools

Mining pools and tools help miners earn more money. Pools let many miners work together to find bitcoin blocks faster. This gives miners regular payouts and helps pay for electricity and other costs. Pools also take care of hard technical jobs, so mining is easier. Monitoring tools help miners check machine health, power use, and temperature. These tools help miners fix problems quickly and keep machines working well.

Note: Picking a pool with low fees and good server spots helps miners earn more and avoid delays.

Managing Risks

Bitcoin mining has risks that can lower profits. The price of bitcoin can change fast, making mining less profitable. Mining machines can get old quickly and stop working well. Rules and electricity prices can change without warning. Miners can handle these risks by:

Getting new machines often to keep up with new technology.

Using renewable energy to avoid big jumps in electricity costs.

Watching the market and joining pools to keep income steady.

Trying cloud mining to avoid owning machines that lose value fast.

Risk Type | Description | How to Manage |

|---|---|---|

Bitcoin price changes can lower profits | Watch markets, join pools | |

Equipment Obsolescence | Old machines lose efficiency and value | Upgrade hardware, try cloud mining |

Electricity/Regulation | Power costs and rules can change quickly | Use renewables, pick safe locations |

Smart miners plan ahead for these risks. This helps them protect their bitcoin mining ROI and keep profits steady.

Electricity prices decide how much money miners can make. Many miners move to places where power is cheaper. Electricity is the biggest cost they have all the time. Using machines that save energy and finding cheap power helps miners earn more. Mining is getting harder, so these things matter even more.

*Miners should:

Check miner details like hash rate, power use, and how efficient they are.

Look up how much electricity costs in their area.

Try ROI calculators like Minerstat or CoinWarz, which include electricity prices.

Making smart choices now will help miners do well later.

FAQ

What is the most important cost in bitcoin mining?

Electricity is the biggest cost for bitcoin miners. Miners pay more for power than for machines or repairs. If electricity is cheap, miners can make more money.

How does machine efficiency affect mining profits?

Efficient machines use less energy for each job. Miners who pick hardware with lower J/TH spend less on power. This helps them earn more and use their machines longer.

Tip: Always look at the efficiency before buying a miner.

Why do miners move to different countries?

Miners go to places where electricity costs less. Cheaper power means they can earn more profit. Some countries also have better rules or lower taxes for mining.

What tools help miners track profitability?

Miners use online calculators and special software. These tools show how much money they make and how much power they use. Minerstat and CoinWarz are popular choices.

Note: Watching costs helps miners make good choices and avoid losing money.

Bitmain

Bitmain Iceriver

Iceriver

Bitdeer

Bitdeer BOMBAX

BOMBAX DragonBall

DragonBall Elphapex

Elphapex Fluminer

Fluminer Goldshell

Goldshell iBelink

iBelink Ipollo

Ipollo Jasminer

Jasminer Volcminer

Volcminer

Aleo Miner

Aleo Miner