Blog

Table of Contents

Bitcoin mining is growing fast in 2025. Both cloud and home mining are getting bigger. Many people think cloud mining is easy for beginners. Home mining gives you more control.

Metric | Cloud Mining | Home Mining (Individual) |

|---|---|---|

Growth in 2025 | 19% expansion | 14% increase (U.S.) |

Hash Rate Contribution | N/A | 10% |

People look at costs, skills, risks, and profits before picking bitcoin mining in 2025. Home mining needs special machines and cheap power. Cloud mining is easier but you must trust the provider. Both choices are popular for people who want to mine bitcoin in 2025.

Key Takeaways

Cloud mining is easy to start. It does not cost much at first. You do not need to know a lot about computers. This is good for beginners. You can earn steady profits. You do not have to take care of machines.

Home mining lets you control everything. You own the equipment. You need to spend a lot of money at first. You must know how to use the machines. You need to watch your energy use. It works best where power is cheap.

Picking the best mining way depends on your money, skills, and what you want. Always think about energy costs. Check if your hardware works well. Use trusted companies. This helps you do better in mining.

What is Online Bitcoin Mining?

Online bitcoin mining is also called cloud mining. It lets people mine bitcoin without buying machines. People rent computer power from big companies. These companies own large data centers. They take care of the hardware and electricity. They also keep the machines cool. Users just sign up and pick a plan. Then they can start earning btc. This way is easier for beginners. It is good for people who do not like technical stuff.

The biggest difference is who owns the equipment. Home miners buy their own machines. These are called ASICs. They pay for electricity and cooling. They must fix problems and keep things working. Online miners do not own any machines. They pay a fee to the company. The company does all the work.

Note: Online bitcoin mining is easier but gives less control. Home mining gives more control but needs more work and skill.

Aspect | Online Bitcoin Mining | Home Bitcoin Mining |

|---|---|---|

Definition | Renting mining power from companies with big data centers. | Owning and running mining machines at home. |

Hardware Ownership | No machines owned; only renting power. | You own and control your mining machines. |

Cost Structure | Lower starting cost; pay service fees; no extra bills. | High starting cost; pay for electricity and repairs. |

Technical Knowledge | Not much skill needed; company handles everything. | Need to know how to set up and fix machines. |

Control & Flexibility | Less control; depends on company rules. | Full control over your mining and machines. |

Risk Factors | Risk of scams or bad companies; fees lower profits. | Risk of broken machines, high bills, and price changes. |

Accessibility | Easier for beginners or people with less money. | Better for experts who want to spend time and money. |

Profit Potential | Usually less profit because of fees and sharing. | Can make more money if managed well. |

Many online bitcoin mining sites are popular in 2025. Some top choices are:

DNSBTC: Gives a $60 bonus and starts mining for you.

MinerGate: Mines many coins and lets you test for free.

Binance Cloud Mining: Works with Binance and has flexible plans.

ECOS: Has safe and customizable btc contracts.

IQMining: Mixes mining and trading and gives free trials.

GMiner: Costs less to start and has short or long contracts.

Online bitcoin mining lets more people join the blockchain. It makes it easier to earn btc and learn about mining.

What is Home Bitcoin Mining?

Home bitcoin mining means using special computers at home to earn btc. People buy their own machines and put them in their house. This way, they control how they mine and keep all the coins they get.

Upfront and Ongoing Costs

Home bitcoin mining in 2025 costs a lot at first. Each ASIC machine costs at least $1,000, unless you choose a smaller solo miner, which is popular with new home miners. Miners also pay for setup, cooling, and fixing their electric system. Every month, they pay for power, repairs, and keeping things working. Cloud mining starts at $200 and covers power and repairs in the fee. But home miners own their machines and can sell them later. Cloud mining only lets you rent, so you do not own anything.

Home Mining | Cloud Mining | |

|---|---|---|

Electricity Costs | Paid by miner; can be less if power is cheap and machines work well | Included in contract fees; no extra payment by user |

Maintenance | Miner fixes and updates machines | Provider handles it; included in fees |

Cooling & Noise | Extra cost for cooling and noise | Included in service; no extra cost to user |

Upfront Investment | Usually high – depends on miner quantity/model. | Low – pay for rental contract |

May pay for electric upgrades, insurance, or time | May pay withdrawal fees or monthly fees | |

Ownership | Miner owns machines and can sell them | No ownership; just renting |

Labor/Time Commitment | High – must check and fix machines often | Low – mostly hands-off after setup |

Profitability and Performance Factors

How much money miners make depends on many things. The most important are how good the machines are, how much power they use, and the price of electricity. The ASICs like Bitmain Antminer S21 Hydro can do about 335 TH/s and use 16 J/TH. If power costs less than $0.05 per kWh, a miner can make about $12.88 a day after paying for power. Each machine can earn $300 to $500 a month. But most U.S. homes pay $0.12–$0.16 per kWh, so mining does not make money unless power is very cheap or green. It usually takes over two years to get your money back.

The market also changes how much miners earn. In 2024, the bitcoin halving made rewards smaller, so miners hope the btc price goes up or they get more from fees. The network gets harder every two weeks, so it is tougher to win rewards. If btc goes up, profits go up. If btc drops or power costs rise, profits go down. Miners in places with cheap power, like Iceland or Canada, do better. Using good machines and green power helps keep costs low and mining strong.

Tip: Miners who want steady money often join mining pools. Pool mining helps even out big changes in the market and network.

Setup Complexity and Maintenance Needs

Setting up home bitcoin mining is not easy. Miners must put in ASICs, hook them to the internet, and handle power and cooling. They need to keep machines working well and stop them from breaking. Some problems are:

Mining rigs are loud and can bother people nearby.

Bad cooling can make machines too hot and break them.

Dust can block fans and make machines overheat.

Not updating software or checking the network can stop mining and lose btc.

Cleaning and checking cooling systems helps save power and keeps machines working.

Frequency | Importance | |

|---|---|---|

Cleaning fans and vents | Monthly | Stops dust from making machines too hot |

Updating firmware | Quarterly | Makes mining better and more stable |

Checking power supply | Monthly | Stops power problems and damage |

Inspecting cooling system | Bi-monthly | Keeps machines cool and safe |

Risks: Security, Financial, and Regulatory

Home bitcoin mining has many risks:

Machines can get too hot, be noisy, or cause power problems and fires.

Money risks include btc losing value, big power bills, or trouble with power companies.

Scams can happen with fake machines or bad cloud mining offers.

New laws might raise power costs or need special permits. Some places may ban or limit home mining because of power use or the environment.

Miners must watch out for scams and follow the rules to keep their money and machines safe.

Control, Ownership, and Privacy

Home mining gives the most control and ownership. The miner owns the machines and chooses how to use them. This way, they can get btc without giving out their identity, which is good for privacy. Home miners pick when to upgrade, sell, or stop mining. They also choose where their power comes from, which can save money.

Cloud mining does not give you machines or much control. The company runs everything, and users just rent power. Privacy is less because users must follow the company’s rules.

Note: Home bitcoin mining gives full control, ownership, and privacy, but you need skill, more money, and must manage power and machines carefully.

Cost Comparison:

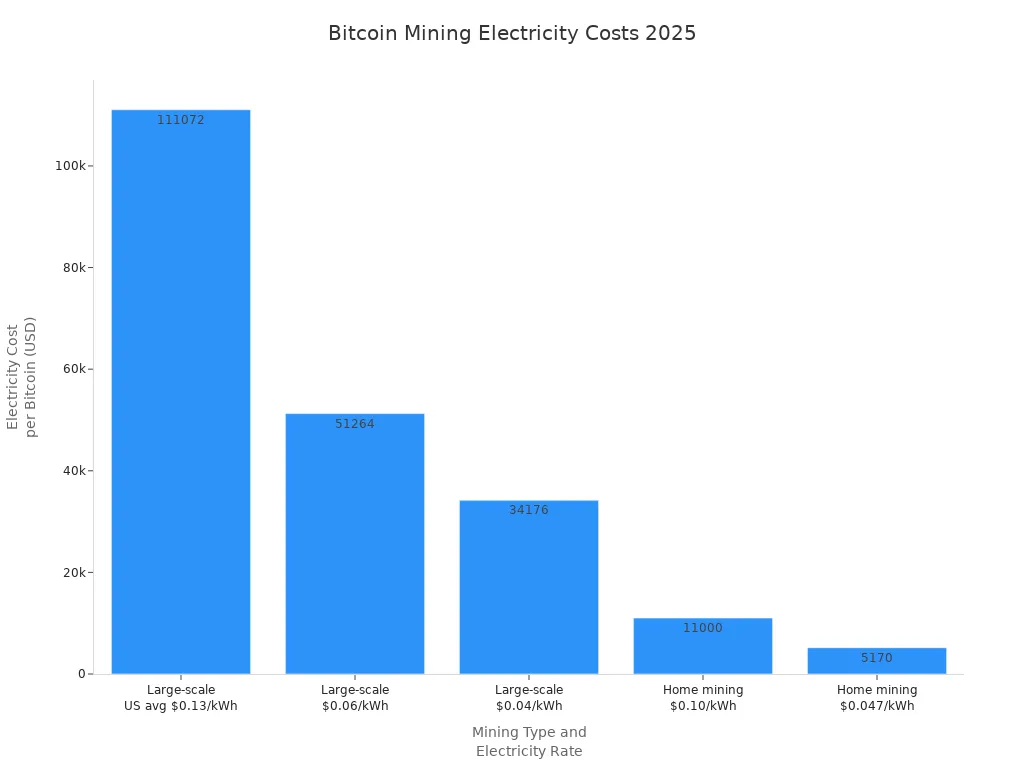

A cost comparison helps miners pick cloud or home mining. Both choices have different costs. Energy is the biggest cost for every miner. Home miners pay for machines, power, and fixing things. Cloud miners pay fees that cover power and repairs. The table below shows how these costs are split:

Mining Type | Electricity Cost per Bitcoin | Hardware Cost | Service Fees | Notes |

|---|---|---|---|---|

Large-scale (US average electricity $0.13/kWh) | $111,072 | Excluded but secondary | Implied (not quantified) | Electricity is dominant cost; hardware and infrastructure costs are less significant. |

Large-scale (at $0.06/kWh) | $51,264 | Excluded but secondary | Implied (not quantified) | Access to cheap electricity drastically reduces costs; available to industrial miners. |

Large-scale (at $0.04/kWh) | $34,176 | Excluded but secondary | Implied (not quantified) | Lowest energy cost miners achieve >70% margins; retail miners cannot compete. |

Home mining (at 10 cents/kWh) | ~$11,000 | Included in overall cost | Mining pool fees mentioned but not explicitly quantified | Home mining electricity cost much lower; hardware efficiency and hash rate affect costs. |

Home mining (at 4.7 cents/kWh) | ~$5,170 | Included in overall cost | Mining pool fees mentioned but not explicitly quantified | Lower electricity rates significantly reduce home mining costs. |

Energy efficiency is very important in mining costs. New ASIC machines use less power and make more bitcoin. These machines cost more money at first. Miners with less money need to think about machine price and power bills. Cloud mining contracts help people skip buying expensive machines. This makes it easier for people with less money. These contracts use AI to save energy and cut waste. This helps keep costs steady.

The market for mining machines keeps getting bigger. High power bills and small profits make home mining tough. Many miners want better energy savings or switch to cloud mining for steady costs. In 2025, energy is still the main cost for both types of mining. Miners should always check their energy use and plan their spending.

Compare Setup and Maintenance

Home bitcoin mining needs many steps to start. Miners pick ASIC hardware that works well and does not cost too much. They put the machine in a cool, safe place with good air flow. This helps keep it from getting too hot. The miner must plug into steady power and use wired internet. This makes sure it works all the time. Miners set up an IP address, join a mining pool, and make a bitcoin wallet for rewards. They add pool and wallet info to the miner and start mining. Checking the miner often helps it work better and saves energy.

ASICs use lots of power and can be loud. Miners install free mining software to connect to the bitcoin network. They think about how much energy they use, how to cool the machine, and how much money they spend at first. They clean fans, update software, and check the temperature. Miners also watch hash rate and power use to stop problems.

Cloud mining is much easier to set up. Users pick a contract and watch their earnings online. The provider takes care of all machines, power, and repairs. No special skills are needed, and users do not touch any machines. This way saves time and means users do not worry about energy.

Aspect | Home Mining Setup & Maintenance | Cloud Mining Setup & Maintenance |

|---|---|---|

Hardware Install | Required | Not required |

Software Config | Required | Not required |

Energy Management | High involvement | Provider handles |

Maintenance | Frequent cleaning, updates | Provider handles |

Time Needed | High | Low |

Skill Level | Advanced | Beginner |

Tip: Home miners can save power by checking cooling and machine efficiency. Cloud miners trust the provider to use energy well.

Cloud and Home Bitcoin Mining Profitability Analysis

How much money you make from bitcoin mining in 2025 depends on many things. Cloud mining companies show profits with set contracts. For example, MiningToken gives a 15–30% return on short contracts. ECOS offers 70–85% returns each year. Some contracts, like IQ Mining, say you can earn even more, but they are riskier. The table below shows how some cloud mining contracts do:

Platform | ROI Type | Average Net Return (%) | Contract Length (days) | Key Risk Factors |

|---|---|---|---|---|

MiningToken | Fixed-Term | 15–30 | 3–10 | New platform, market volatility |

ECOS | Long-Term | 70–85 (annual) | 180–360 | BTC price changes, long lock-in |

StormGain | App-Based | <5 (monthly) | No contract | ROI tied to user activity |

IQ Mining | Lifetime | 70–200 (varies) | Until unprofitable | Mixed trust, hidden fees |

Cloud mining does not need you to buy machines or pay for power. You do not have to worry about how well the machines work. You get paid every day based on your contract. Some short contracts, like IeByte, can make $16 to $8,550 in a few days. These contracts make it easy to see how much you might earn.

Home mining is different. Higher power prices and harder mining make it tough to earn money. Most home miners have trouble paying their power bills. Even with good ASICs, saving power does not always help enough. Big pools with better power use win most rewards. Home miners also pay pool fees, which means less money for them. How you get paid matters. PPS gives steady money but may miss extra rewards from fees. FPPS and PPS+ give both block rewards and transaction fees, so you can earn more.

Miners in pools get steadier payouts, but higher pool fees mean they keep less. Cloud miners pay provider fees, which also lower their profits.

Power is still the biggest cost for both ways of mining. Cloud mining uses smart energy tricks in big data centers. Home miners must save power and keep machines cool to do better. In 2025, most people find home mining does not make money unless power is very cheap. Cloud mining gives steadier profits and is easier, so many people pick it to join the blockchain and earn rewards.

Home Mining Equipment and ASICs

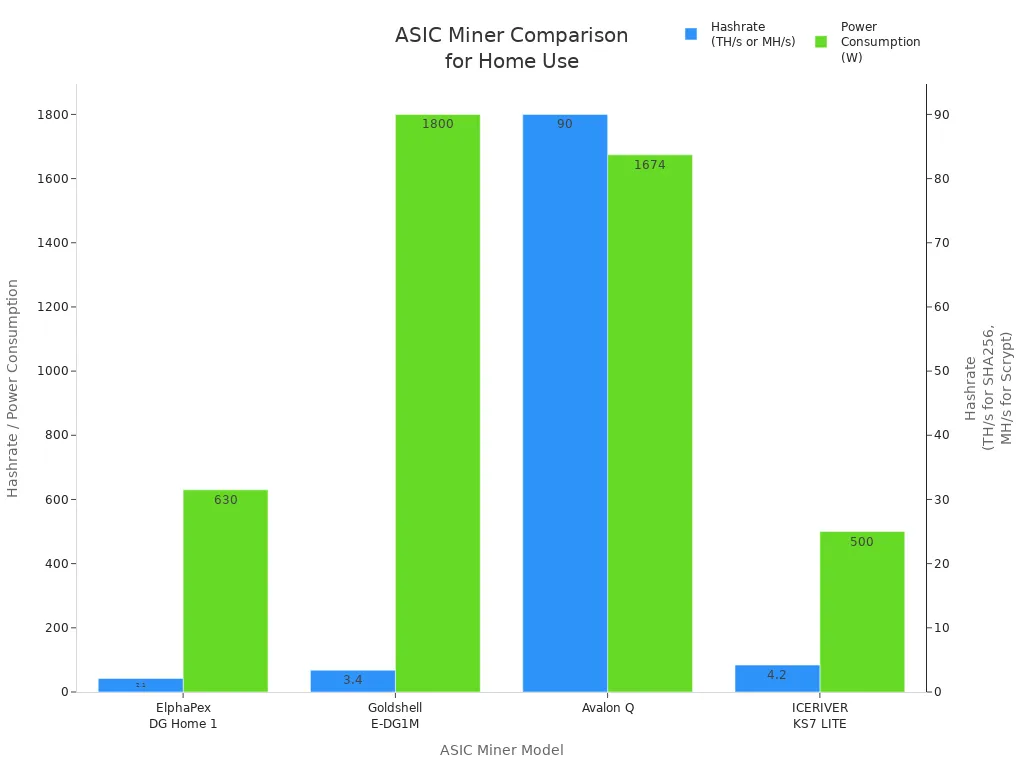

Top ASIC Recommendations

Picking the right asic is very important for home mining in 2025. The Bitmain Antminer S23 318T is one of the top crypto miners. It works well and has a hashrate of 318 TH/s. It uses 3,498 watts of power. Its efficiency is 11 J/TH, which helps save energy. This model fits in small rooms and does not make much noise. Bitmain is known for good support and warranty. Miners should think about size, warranty, and brand when buying crypto mining hardware.

Power and Cooling

Managing energy is very important for home mining. Strong asic machines need good cooling to work well and not get too hot. New asic chips from Auradine, Block, and Intel use advanced 3nm and 4nm tech. These chips help save energy and make less noise. Some miners use hydro-cooled units that reach about 14.5 J/TH. Miners can use heat from asic machines to warm greenhouses or as bitcoin mining heaters. This makes energy use better for the environment.

ASIC Miner Model | Power Consumption | Hashrate | Noise Level | Recommended Use Case |

|---|---|---|---|---|

630 W | 2100 MH/s | ~47 dB | Small households; quiet, energy efficient | |

1800 W | 3400 MH/s | <45 dB | Beginner-friendly for LTC, DOGE mining | |

1674 W | 90 TH/s | 45-60 dB | Home miners focused on Bitcoin mining | |

500 W | 4.2 TH/s | N/A | Low-cost mining using surplus energy |

Mining Pools and Software

Mining pools help home miners get steady rewards. Pools join the power and work of many miners to win more coins. Popular software like CGMiner and BFGMiner lets users watch asic performance and energy use. These tools help miners change settings for better results. Joining a pool and using good software helps beginners do better and makes home mining easier.

Tip: Miners should check energy use and cooling often. This keeps asic machines working well and helps them perform better.

Decision Guide

Checklist

Picking between cloud and home bitcoin mining in 2025 is important. This checklist helps you find the best way for your needs:

Match mining software or cloud service to your skill. Beginners can use EasyMiner or NiceHash. Advanced users may pick BFGMiner or CGMiner.

Check hash-rate efficiency and how often you get rewards. Look for steady performance and weekly payouts.

Make sure mining pools and cloud providers are trusted. Check for good uptime, clear fees, and strong security.

Think about long-term flexibility. Some mining software works with many algorithms. Some cloud contracts let you cancel or upgrade easily.

Add up electricity costs and hardware compatibility. ASICs work best for bitcoin. GPUs may be better for other coins.

Look at sustainability and energy efficiency. Efficient machines and green energy help miners compete.

Pick a cryptocurrency that fits your hardware and profit goals.

Build a mining rig with a GPU computer or buy ASIC hardware.

Install mining software like CGMiner, NiceHash, or PhoenixMiner.

Join a mining pool like F2Pool, Slush Pool, or 2Miners for steady rewards.

Watch electricity use, change settings, and keep up with network difficulty.

Tip: Always check energy prices and hardware updates before you choose.

The table below shows key things to compare for home and cloud mining:

Factor Category | Home Mining Considerations | Cloud Mining Considerations |

|---|---|---|

Profitability Factors | Market prices, mining difficulty, equipment efficiency, electricity costs, hardware lifespan | Contract terms, maintenance fees, provider performance, market prices, mining difficulty |

Risks | Hardware failure, market changes, legal issues, security problems | Provider reliability, scams, contract limits, market risks |

Investment & Costs | High upfront hardware cost, lower ongoing costs if electricity is cheap | Lower upfront cost, monthly fees and contract costs |

Control vs Convenience | Full control over equipment and mining strategy | Hands-off, less control over mining |

Learning Curve | Hard to learn, needs technical knowledge | Easy setup, little technical skill needed |

Environmental Impact | High power use, depends on electricity source | Can be greener if provider uses renewable energy |

Common Scenarios

Different people have different goals and resources. Here are some common situations and tips for 2025:

- Beginners and Hobbyists

Many beginners want to mine without spending much or learning hard skills. Cloud mining platforms like DNSBTC give free bonuses and short contracts. These let users mine bitcoin and get rewards without buying hardware. Hashmart and MultiMiner are good for hobbyists with low prices and easy contracts. - Intermediate Users

Some users want more control and bigger rewards but do not want to handle hardware. ECOS offers flexible investments, longer contracts, and built-in crypto wallets. These users pick contracts that fit their budget and risk. MinerGate and BeMine offer shared hosting and easy management for those who want both cloud and hardware mining. - Professional Miners and Investors

Professional miners focus on efficient hardware, energy use, and business planning. They use advanced ASIC miners, join mining pools, and set up farms where energy is cheap. They watch pool performance, fees, and hardware efficiency to get more rewards. They also earn more by joining DeFi platforms or staking other cryptocurrencies. Big users may pick BitFuFu or Binance Cloud Mining for high hashrate and links to big exchanges. - Tech Enthusiasts

Tech fans like building and improving mining rigs. They use software like NiceHash for switching algorithms and control. Home miners who want quiet and control may pick hardware like Avalon Nano 3S. These users try different energy sources, like solar or wind, to save money and help the environment. - Small-Scale Miners

Small miners join mining pools to get more rewards. Pools like F2Pool or Slush Pool give rewards based on hashrate. Beginners like pools with FPPS for steady income, even if fees are higher. Cloud mining also helps small miners skip hardware costs and hard setup. Professional miners should make business plans, pick sites with cheap energy, and plan for cooling and hardware upgrades. Managing risks and learning new tech are important for long-term success. - Environmental Considerations

People who care about the environment should pick providers using renewable energy. Home miners can use green energy to lower costs and help the planet. Efficient hardware and smart energy use help all miners stay competitive.

By using this guide, you can pick the mining method that fits your skills, budget, and goals. Each way gives different control, risk, and reward. Knowing energy costs and mining strategies helps you make the best choice for 2025.

Bitcoin mining in 2025 needs good planning. People should look at costs, risks, and skills before picking home or cloud mining. The decision guide and ASIC advice help people reach their goals. Keeping up with market and rule changes keeps bitcoin mining safe and helps people make money in 2025.

FAQ

What is the main risk of cloud bitcoin mining?

Cloud mining companies can disappear or stop paying. Users may lose money if the provider is not honest or goes out of business.

Tip: Always check reviews before choosing a cloud mining provider.

Can home bitcoin mining make money in 2025?

Home mining can make money if electricity is cheap and the miner uses efficient hardware. High power costs can make profits very low.

Do you need special skills for home bitcoin mining?

Yes. Home miners must set up machines, fix problems, and manage cooling. Basic computer and electrical knowledge helps keep mining safe and efficient.

Bitmain

Bitmain Iceriver

Iceriver

Bitdeer

Bitdeer BOMBAX

BOMBAX DragonBall

DragonBall Elphapex

Elphapex Fluminer

Fluminer Goldshell

Goldshell iBelink

iBelink Ipollo

Ipollo Jasminer

Jasminer Volcminer

Volcminer

Aleo Miner

Aleo Miner