Blog

Long-term investors often seek to align bitcoin mining operations with clear investment goals. Growing capacity, controlling costs, and building financial strength support better outcomes. Historical data shows that miners who focus on these strategies can endure downturns and benefit from bitcoin price recoveries. Bitcoin mining and investment strategies that prioritize scale and efficiency help investors survive bear markets. These approaches, paired with prudent management, enhance profitability over a five-year period.

Key Takeaways

Choose energy-efficient mining hardware and low-cost electricity to reduce expenses and boost long-term profits.

Regularly monitor mining operations and market trends to quickly adapt and maintain strong returns.

Avoid common mistakes like chasing hype coins or ignoring true costs by planning carefully and diversifying investments.

Crypto Mining Strategy

Hardware Selection

Long-term investors in bitcoin mining must evaluate several criteria before choosing a miner. The most important factors include electricity costs, hardware efficiency, and operational optimization. Electricity costs often account for 60-70% of mining expenses, making low-cost power essential for profitability. Hardware efficiency reduces energy consumption and extends the lifespan of the miner. Investors should also consider company reputation, infrastructure, and mining pool ownership. The table below summarizes these criteria:

Criteria Category | Key Points and Explanation |

|---|---|

Electricity Costs | Constitutes 60-70% of mining expenses; low-cost electricity is critical for profitability and long-term viability. |

Hardware Efficiency | New generation mining hardware offers incremental efficiency improvements; technological obsolescence risk is low. |

Ability to optimize data center operations (OPEX) enhances profitability and sustainability. | |

Company Reputation | Years in business (5+ years indicates resilience), public status (access to funds), and vertical integration (control over supply chain and operations). |

Infrastructure & Assets | Ownership of land, number and geography of data centers, power capacity, and infrastructure mobility (mobile vs fixed). |

Mining Pool Ownership | Reduces counterparty risk and improves cash flow stability by sharing hash rate internally. |

Transparency & Cost Structure | Clear understanding of cost structure and transparent public information (team, locations, services) supports risk management. |

ASIC miners such as the Bitmain Antminer S21 XP Hydro and S21 Pro offer high energy efficiency and suit both industrial and large-scale residential setups.

Efficiency

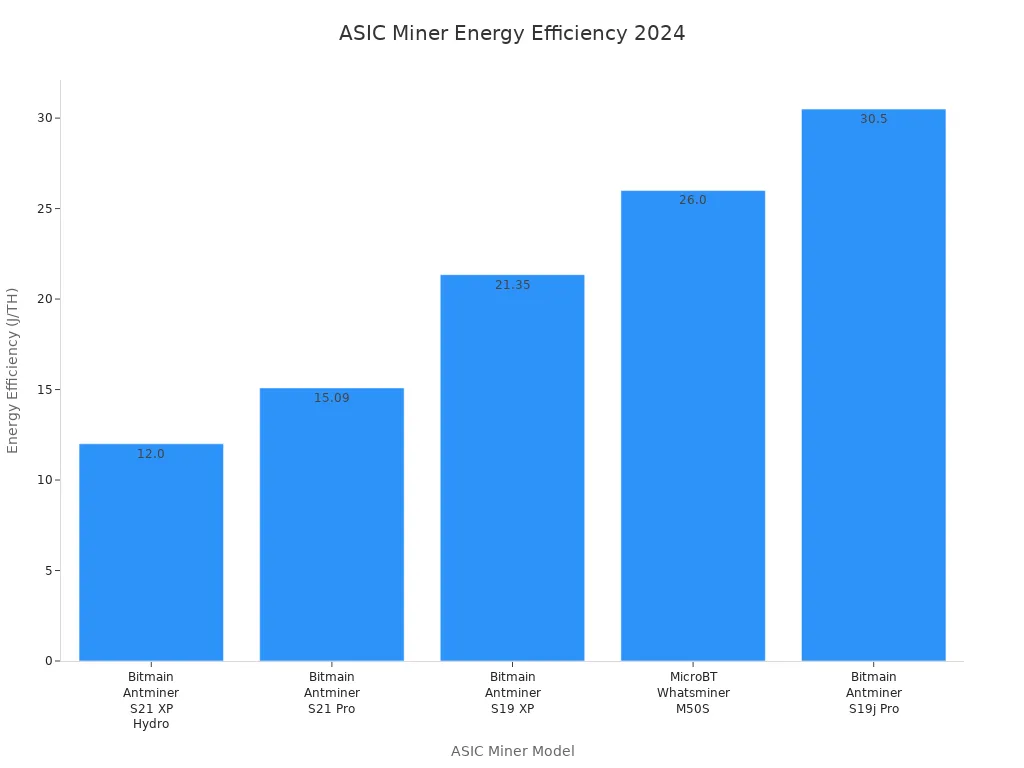

Efficiency plays a central role in high-performance bitcoin mining. ASIC miner efficiency determines how much bitcoin a miner can generate per unit of energy. The chart below compares the energy efficiency of top ASIC miners in 2024:

Efficient miners optimize hash rates and reduce idle time, which leads to faster block confirmations and higher mining output. Lower energy consumption directly reduces operational costs. Advanced ASIC models also prevent overheating and extend hardware lifespan, which lowers replacement costs. AI-driven management can further improve efficiency by predicting maintenance needs and adjusting mining strategies in real time.

ROI

Return on investment, or ROI, remains a top priority for bitcoin mining operations. Investors must calculate ROI by considering initial investment cost, operational costs, and expected mining output. ASIC miners with high energy efficiency, such as the Bitmain Antminer S21 XP Hydro, deliver better ROI due to lower electricity usage and higher hash rates. Investors should also factor in hardware durability and the ability to adapt to changing bitcoin network conditions. Consistent monitoring of ROI helps investors make informed decisions about upgrading or scaling their mining operations.

Risk Management

Effective risk management protects bitcoin mining investments from market volatility and operational threats. Investors should maintain strong governance and regulatory compliance. Robust KYC and AML programs reduce fraud and legal risks. Regular education on security threats and real-time transaction monitoring help detect suspicious activities. Using secure exchange software and developing a comprehensive incident response plan further strengthens risk management. Diversifying investments across different cryptocurrencies and asset classes also reduces exposure to bitcoin price swings. These strategies help miners safeguard their ROI and ensure long-term sustainability.

Bitcoin Market Fundamentals

Bitcoin Supply and Halving Events

Bitcoin fundamental analysis starts with understanding its fixed supply. The code limits the total bitcoin supply to 21 million. Every four years, a halving event cuts the block reward by 50%. This event reduces the flow of new coins, increasing scarcity and affecting demand. The table below shows how past halvings impacted mining profitability, price, and market behavior:

Aspect | Evidence Summary |

|---|---|

Impact on Mining Profitability | Halving reduces block rewards by 50%, compressing miners' profit margins if Bitcoin price does not rise quickly. |

Historical Price Behavior | Bitcoin price tends to appreciate significantly post-halving but with a delay of several months to years. |

Mining Industry Response | Miners improve operational efficiency, pursue mergers and acquisitions, and diversify revenue streams (e.g., AI computing). |

Short-term Challenges | Post-halving, miners face revenue pressure due to lower rewards and high electricity costs; some see production drops. |

Long-term Outlook | Supply constraints and network adaptations support a promising future for Bitcoin and mining profitability. |

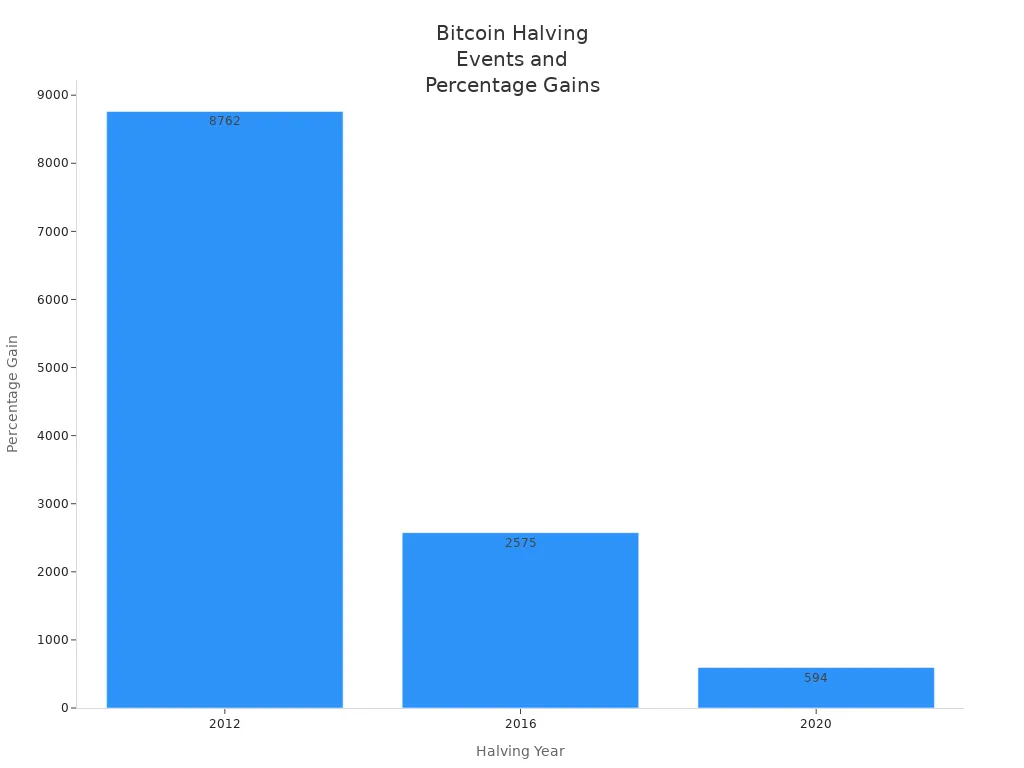

Bitcoin fundamental analysis also examines historical price trends after each halving. The chart below highlights the percentage gains in bitcoin price following each halving event:

Supply constraints, combined with growing demand and user adoption, often drive price appreciation. Market fundamentals suggest that the next halving could again boost bitcoin price and mining profitability.

Hashrate and Valuation Models

Hashrate measures the total computational power securing the bitcoin network. High hashrates signal strong miner competition and network security. Bitcoin fundamental analysis uses hashrate trends to assess market health. When bitcoin price rises, more miners join, increasing hashrate. In bear markets, less efficient miners exit, causing hashrate to drop. The relationship between hashrate and price is not instant; delays can occur due to external factors like regulatory changes or electricity costs.

Hashrate generally follows bitcoin price, not the other way around.

High hashrates reflect significant investment and confidence in long term fundamentals.

Market valuation models, such as stock-to-flow, use supply and demand to forecast price. The stock-to-flow model predicts higher prices as bitcoin becomes scarcer after each halving.

Production cost models suggest that bitcoin price gravitates toward the cost of mining, but market demand and adoption often drive price above production costs.

Bitcoin fundamental analysis also considers market sentiment, regulatory trends, and institutional adoption. These factors influence demand, supply, and ultimately, mining profitability. As user adoption grows and market demand increases, bitcoin price and hashrate are likely to rise, supporting a positive outlook for miners.

Top Bitcoin Miner

Selecting the best bitcoin miner requires careful analysis of performance, adaptability, and operational context. Regulatory changes and market volatility often drive miners to relocate or upgrade hardware. Many large mining farms move to regions with favorable laws and lower costs. Technological evolution also shapes the landscape, with miners adopting advanced cooling, energy-efficient asic models, and AI integration to maintain competitiveness.

Bitmain Antminer S21+ Hyd 319T

The Bitmain Antminer S21+ Hyd 319T delivers a hash rate of 319 TH/s and energy efficiency of 15 J/TH. This miner offers moderate performance compared to other leading asic models. The table below highlights how it compares to similar miners:

Model | Hash Rate (TH/s) | Energy Efficiency (J/TH) |

|---|---|---|

Antminer S21+ Hyd | 319 | 15 |

Antminer S21+ | 216 | 16.5 |

Antminer S21XP Hydro | 473 | 12.7 |

Antminer S21 XP | 270 | 13.5 |

U3S21EXPH | 860 | N/A |

Bitmain Antminer S21 XP Hyd 473T

This best bitcoin miner targets large-scale operations. It features a 473 TH/s hash rate and 5676W power consumption. Its hydro-cooling system ensures stable temperatures and reduces thermal throttling. Operators benefit from advanced firmware, dynamic voltage adjustment, and secure remote management. The S21 XP Hyd supports continuous, efficient mining in professional data centers.

Utilizes hydro-cooling for stable operation and low noise.

Delivers high hash rates for significant bitcoin network tasks.

Offers excellent efficiency, lowering mining costs.

Requires dedicated power and specialized installation.

Bitmain Antminer S23 Hyd 3U 1.16P

The S23 Hyd 3U 1.16P stands out for its high hash rate, making it suitable for industrial bitcoin mining. Its robust design and advanced cooling support long-term reliability. This miner fits operations that prioritize performance and scalability.

Bitmain Antminer S21e XP Hyd 3U 860T

With a hash rate of 860 TH/s, the S21e XP Hyd 3U leads in raw performance. Its advanced cooling and asic architecture support high-density mining environments. Operators seeking maximum output often select this miner for their bitcoin operations.

Bitdeer SealMiner A2 Pro Hyd 500T

The SealMiner A2 Pro Hyd 500T achieves a 500 TH/s hash rate but consumes 7,450W. While it offers strong performance, its higher operational cost may affect long-term profitability compared to more efficient miners. The chart below shows its position among top miners:

MicroBT WhatsMiner M63S+ 424T

The WhatsMiner M63S+ 424T provides a 424 TH/s hash rate and 7,208W power consumption. It supports SHA-256 mining and offers reliable daily profit. Long-term investors value this miner for its consistent performance and compatibility with evolving bitcoin network demands.

Tip: Miners can adapt to technological shifts by upgrading hardware, joining mining pools. These strategies help maintain efficiency and profitability in changing markets.

Bitcoin Mining and Investment Strategies

Monitoring and Adjustment

Practical Steps for Monitoring

Investors should use reliable tools and metrics to track the performance of their bitcoin mining operations. The following resources provide essential insights:

Foundry OptiFleet™ offers Real-time site monitoring, automation, and energy optimization. It helps optimize energy use and reduce downtime.

The Bitcoin Hashprice Index measures expected rewards per unit of hashrate, giving a clear view of miner profitability.

The Bitcoin ASIC Price Index tracks the prices of mining hardware across different efficiency levels, updated weekly.

Mining pool data shows the latest blocks and total hashrate, helping investors understand network activity.

The Bitcoin ASIC Miner Profitability Database allows comparison of hardware efficiency and specifications.

Bitcoin mining calculators estimate profitability by considering electricity costs and hardware performance.

Hashrate converters and embeddable widgets provide real-time data on network hashrate and daily revenue.

Tip: Long-term success in bitcoin mining and investment strategies requires continuous monitoring. Regular metric reviews help spot issues early and guide scaling decisions.

Ongoing Analysis and Adaptability

Ongoing analysis of market trends plays a critical role in the long-term success of bitcoin mining and investment strategies. Investors who monitor adoption rates and price fluctuations can optimize their operations for maximum profitability. Technological innovations, such as new energy-efficient ASIC miners, reduce operational costs and improve efficiency. Understanding government regulations and regional policies helps investors avoid compliance risks and select the best locations for their mining activities.

A successful strategy includes:

Tracking cryptocurrency adoption and price movements to adjust mining output and investment levels.

Staying updated on new hardware releases and technological advancements to maintain a competitive edge.

Analyzing regional factors, such as electricity costs and infrastructure, to guide decisions on hardware purchases and site selection.

Conducting competitive analysis to understand market positioning and anticipate shifts in demand.

Note: Ongoing market analysis supports better risk management and operational improvements, increasing the sustainability and growth potential of bitcoin mining investments.

Avoiding Common Mistakes

Many long-term investors make avoidable mistakes that can undermine their bitcoin mining and investment strategies. The most common errors include:

Mistake | How to Avoid |

|---|---|

Chasing hype coins | Research fundamentals, monitor development, set exit rules |

Quitting mining too early | Adopt a long-term mindset, focus on optimization |

Ignoring true costs | Include all expenses, review contracts carefully |

Wrong hardware/hosting choice | Evaluate efficiency, reputation, and service quality |

Lack of diversification | Spread operations across regions and providers |

Overestimating profitability | Use conservative financial projections |

Callout: Investors who avoid these mistakes and commit to ongoing analysis position themselves for long-term success in bitcoin mining and investment strategies.

Summary

Continuous monitoring, regular analysis, and adaptability form the foundation of effective bitcoin mining and investment strategies. Investors who use advanced tools, track key metrics, and learn from common mistakes can optimize their operations and achieve sustainable growth. The market rewards those who stay informed and flexible, especially as bitcoin adoption and technology continue to evolve.

Long-term investors benefit from integrating hardware selection and market fundamentals. The table below compares ASIC and GPU mining options:

Feature | ASIC (Application-Specific Integrated Circuit) | GPU (Graphics Processing Unit) |

|---|---|---|

Performance | Very high efficiency | Moderate efficiency |

Cost | High initial cost | Lower upfront cost |

Noise & Heat | Louder, more heat | Quieter, less heat |

Mining Flexibility | Limited to specific coins | Can mine various coins |

Setup Difficulty | Plug-and-play | Requires technical knowledge |

Efficient hardware, energy management, and mining pool participation support consistent rewards.

Monitoring operational factors and market trends helps investors adapt and sustain profitability.

FAQ

What is the best way to calculate bitcoin mining profitability?

Miners use calculators that factor in hardware efficiency, electricity cost, and bitcoin price. These tools help estimate daily, monthly, and yearly profits.

How often should miners upgrade their hardware?

Miners should review hardware performance every year. Upgrading becomes necessary when new models offer much better efficiency or when old units become unprofitable.

Do mining pools increase long-term profitability?

Yes. Mining pools combine resources from many miners. This approach provides more stable and predictable rewards compared to solo mining.

Bitmain

Bitmain Iceriver

Iceriver

Bitdeer

Bitdeer BOMBAX

BOMBAX DragonBall

DragonBall Elphapex

Elphapex Fluminer

Fluminer Goldshell

Goldshell iBelink

iBelink Ipollo

Ipollo Jasminer

Jasminer Volcminer

Volcminer

Aleo Miner

Aleo Miner